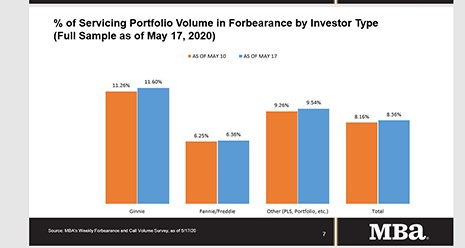

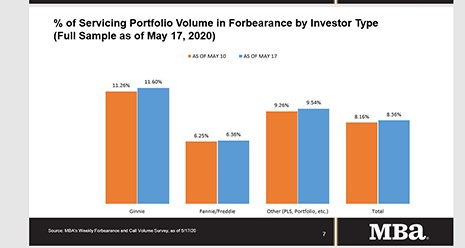

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Tag: Independent Mortgage Banks

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

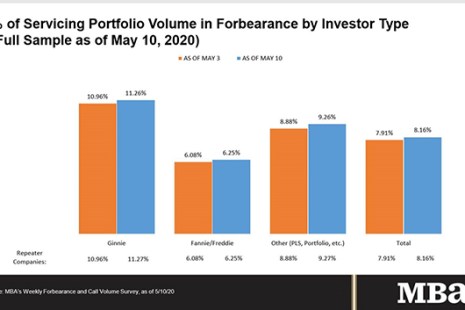

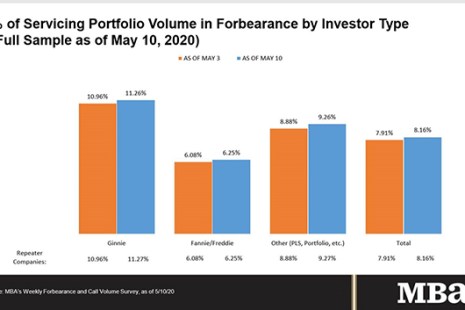

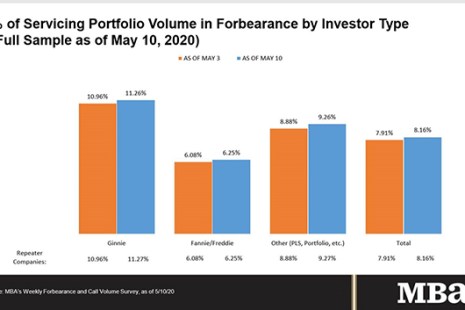

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

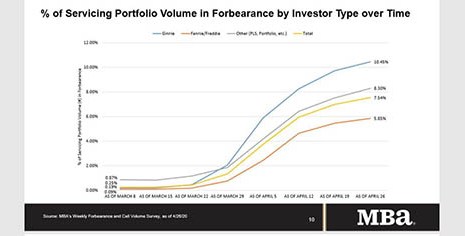

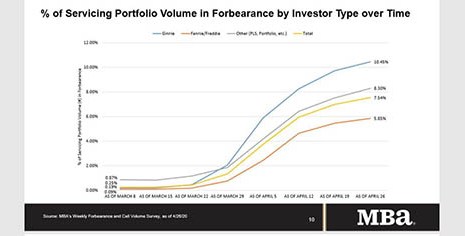

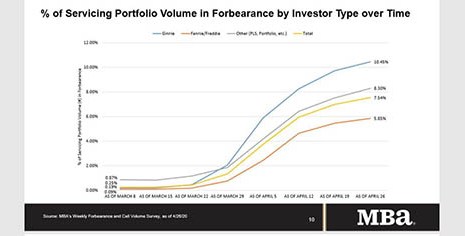

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.80 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed the number of loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, a total of 3.80 million homeowners are now in forbearance plans.

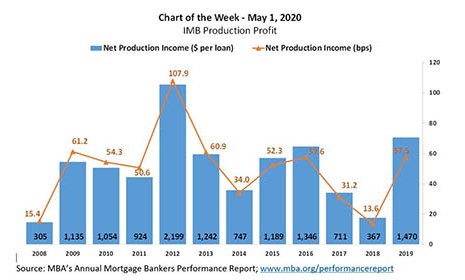

MBA Chart of the Week: IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 58 basis points ($1,470 on each loan they originated) in 2019, up from 14 basis points ($367 per loan) in 2018, according to the MBA Annual Mortgage Bankers Performance Report, released last month.