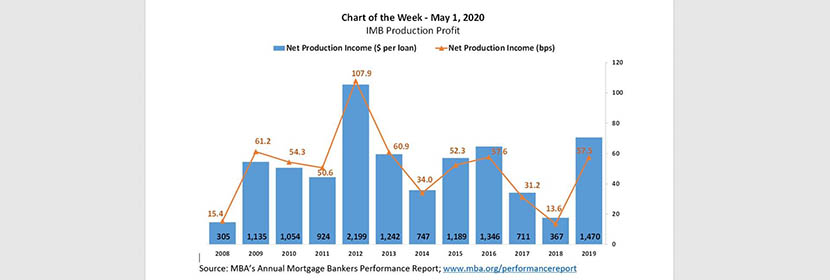

MBA Chart of the Week: IMB Production Profits

Source: MBA Annual Mortgage Bankers Performance Report, www.mba.org/performancereport.

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 58 basis points ($1,470 on each loan they originated) in 2019, up from 14 basis points ($367 per loan) in 2018, according to the MBA Annual Mortgage Bankers Performance Report, released last month.

There were several contributing factors to the overall growth in production profitability for IMBs in 2019. Total loan production expenses (commissions, compensation, occupancy, equipment, other production expenses and corporate allocations) decreased from $8,278 per loan in 2018 to $7,535 per loan in 2019. On a per loan basis, revenues (fee income, net secondary marketing income and warehouse spread) increased from $8,645 per loan in 2018 to $9,004 per loan in 2019.

The refinance share of loans (% based on $) grew from 24 percent in the first half of 2019 to 41 percent in the second half of 2019. Refinances averaged just 20 percent in 2018. Additionally, first mortgage loan balances reached a study high of $266,533 last year.

Including all business lines (both production and servicing), 92 percent of the firms in the study

posted pre-tax net financial profits in 2019, up from 69 percent in 2018.

MBA will release the Q1 2020 edition of the Quarterly Mortgage Bankers Performance Report in early June.

—Marina Walsh mwalsh@mba.org; Jenny Masoud jmasoud@mba.org.