MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

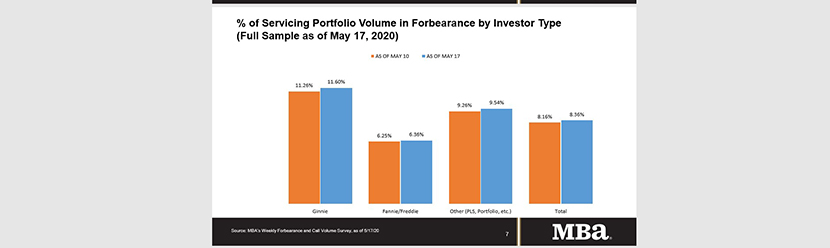

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

The report said mortgages backed by Ginnie Mae again saw the largest overall share of loans in forbearance by investor type (11.60%) and the largest increase from the previous week (34 basis points). Loans in forbearance for depository servicers rose to 9.13%, while loans in forbearance for independent mortgage bank servicers increased to 8.11%. Over the past four weeks, the difference between the percentage of loans in forbearance for depository servicers compared to IMB servicers has narrowed, from 135 basis points as of April 19 to 102 basis points as of May 17.

“Although job losses continue at extremely high rates, mortgage servicers are reporting only modest increases in the share of loans in forbearance as of May 17,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “The decline in employment and income is hitting FHA and VA borrowers harder, leading to 11.6 percent of Ginnie Mae loans currently in forbearance.”

Fratantoni noted forbearance requests declined from a week ago. “And while call volume picked up, servicers appear well staffed for this volume, as wait times and abandonment rates dropped,” he said.

Key findings of the MBA Forbearance and Call Volume Survey – May 11 to May 17:

• Total loans in forbearance grew relative to the prior week: from 8.16% to 8.36%. This 20-basis-point weekly increase was the smallest increase reported since the week of March 9.

o By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week: from 11.26% to 11.60%.

o The share of Fannie Mae and Freddie Mac loans in forbearance increased relative to the prior week: from 6.25% to 6.36%.

o The share of other loans (e.g., private-label securities and portfolio loans) in forbearance increased relative to the prior week: from 9.26% to 9.54%.

• Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the sixth consecutive week relative to the prior week: from 0.32% to 0.28%.

• Weekly servicer call center volume:

o As a percent of servicing portfolio volume (#), calls increased from 7.8% to 8.6%.

o Average speed to answer decreased relative to the prior week from 2.0 minutes to 1.6 minutes. o Abandonment rates decreased from 5.3% to 4.6%.

o Average call length increased from 6.7 minutes to 7.0 minutes.

• Loans in forbearance as a share of servicing portfolio volume (#) as of May 17:

o Total: 8.36% (previous week: 8.16%)

o IMBs: 8.11% (previous week: 7.85%) o Depositories: 9.13% (previous week: 8.99%)

The Forbearance and Call Volume Survey covers May 11-17 and represents nearly 77% of the first-mortgage servicing market (38.3 million loans).