MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

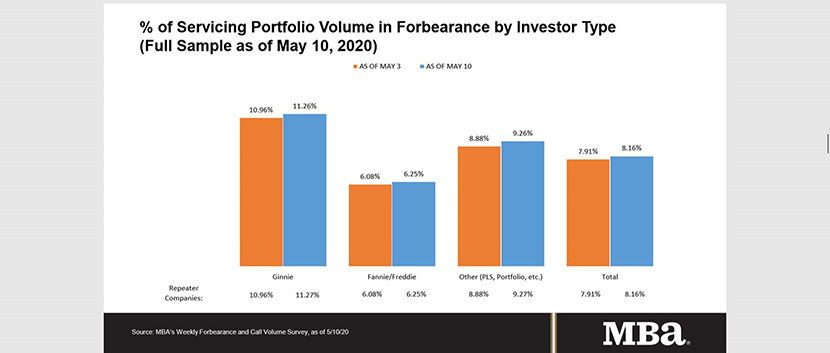

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA now estimates 4.1 million homeowners are in forbearance plans.

The report said mortgages backed by Ginnie Mae again saw the largest overall share of loans in forbearance by investor type (11.26%). Loans in forbearance for depository servicers rose to 8.99%, while loans in forbearance for independent mortgage bank servicers increased to 7.85%.

“The pace of forbearance requests continued to slow in the second week of May, but the share of loans in forbearance increased,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “There has been a pronounced flattening in loans put into forbearance – despite April’s uniformly negative economic data, remarkably high unemployment, and it now being past May payment due dates. However, FHA and VA borrowers are more likely to be employed in the sectors hardest hit in this crisis, which is why more than 11 percent of Ginnie Mae loans are currently in forbearance.”

Fratantoni noted record-low mortgages rates are sustaining the refinance wave, “helping homeowners lower their mortgage payments and save money during these challenging times. Furthermore, the consecutive increase in purchase applications in the past four weeks is a sign that housing demand is strengthening as more states ease restrictions on activity and people get back to work.”

“We will continue to closely monitor the forbearance request and call volume data for any sign of an uptick, but current trends suggest that if the economy continues to gradually reopen, the situation could be stabilizing,” Fratantoni said.

Key findings of MBA Forbearance and Call Volume Survey – May 4 – 10

- Total loans in forbearance grew relative to the prior week from 7.91% to 8.16%. This 25 basis-point weekly increase was the smallest increase reported since the week of March 16.

- By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week: from 10.96% to 11.26%.

- The share of Fannie Mae and Freddie Mac loans in forbearance increased relative to the prior week: from 6.08% to 6.25%.

- The share of other loans (e.g., private-label securities and portfolio loans) in forbearance increased relative to the prior week: from 8.88% to 9.26%.

- Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the fifth consecutive week relative to the prior week: from 0.51% to 0.32%.

- Weekly servicer call center volume dropped back down this week:

- As a percent of servicing portfolio volume (#), calls decreased from 8.6% to 7.8%.

- Average speed to answer decreased relative to the prior week from 2.6 minutes to 2.0 minutes.

- Abandonment rates decreased from 6.6% to 5.3%.

- Average call length decreased – from 7.4 minutes to 6.7 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of May 10, 2020:

- Total: 8.16% (previous week: 7.91%)

- IMBs: 7.85% (previous week: 7.54%)

- Depositories: 8.99% (previous week: 8.75%)

The MBA Forbearance and Call Volume Survey represents nearly 77% of the first-mortgage servicing market (38.3 million loans).