The Consumer Financial Protection Bureau issued another report of its analysis of Home Mortgage Disclosure Act data on Thursday, noting closed-end mortgage originations, as well as applications, increased substantially between 2019 and 2020.

Tag: Home Mortgage Disclosure Act

CFPB Report: Refi Loans Drove Increase in 2020 Closed-End Originations

The Consumer Financial Protection Bureau issued another report of its analysis of Home Mortgage Disclosure Act data on Thursday, noting closed-end mortgage originations, as well as applications, increased substantially between 2019 and 2020.

MBA: Multifamily Lending Hits $360 Billion in 2020

Last year 2,140 different multifamily lenders provided a total of $359.7 billion in new mortgages for apartment buildings with five or more units, the Mortgage Bankers Association reported.

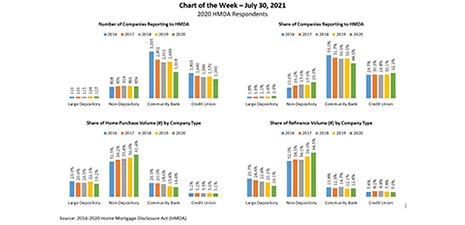

MBA Chart of the Week Aug. 2, 2021: HMDA Respondents

A total of 4,309 companies reported lending activity under the Home Mortgage Disclosure Act in 2020, according to MBA’s own analyses of the dataset.

Dave Parker: CFPB’s New Attitude Toward HMDA Fuels Need for Better Tools

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

Dave Parker: CFPB’s New Attitude Toward HMDA Fuels Need for Better Tools

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

Dave Parker: CFPB’s New Attitude Toward HMDA Fuels Need for Better Tools

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

Dave Parker: CFPB’s New Attitude Toward HMDA Fuels Need for Better Tools

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

Dave Parker: CFPB’s New Attitude Toward HMDA Fuels Need for Better Tools

As it typically happens with a new presidential administration, there’s a new attitude in Washington toward the housing market. And one of the most significant changes has been the CFPB’s recent decision to roll back flexibility when reporting Home Mortgage Disclosure Act data. But are lenders ready?

Tai Christensen of CBC Mortgage Agency: Black Homeowner Equity Takes Big Step in Right Direction

Tai Christensen is the Diversity, Equity and Inclusion Officer and the Director of Government Affairs for CBC Mortgage Agency, a national down payment assistance provider, and has 17 years of experience in the mortgage industry.