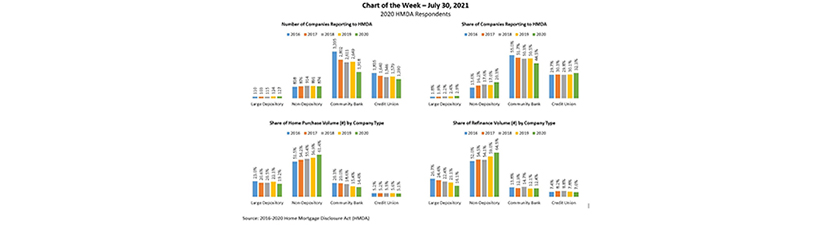

MBA Chart of the Week Aug. 2, 2021: HMDA Respondents

A total of 4,309 companies reported lending activity under the Home Mortgage Disclosure Act in 2020, according to MBA’s own analyses of the dataset.

Company types are defined by regulator and assets, as follows:

- Large depositories are regulated by the OCC, FRS, FDIC, or CFPB and hold more than $10 billion in assets

- Community banks are also regulated by the OCC, FRS, FDIC, or CFPB but hold less than $10 billion in assets

- Credit unions are regulated by the NCUA

- Non-depositories are regulated by HUD

Large depositories have always been the smallest group of HMDA reporters, averaging 100-130 companies over the past five years and comprising no more than 3% of all reporters. In 2020, 127 large depositories made up 2.9% of all HMDA reporters – their highest share since 2008, the first year MBA started tracking this data. Large depositories hold the second-largest market share and originated 19.2% of all home purchase loans and 16.1% of all refinance loans in 2020. However, these shares are the lowest on record for the largest depositories, and a far cry from the 47.7% purchase and 52.1% refinance market shares they held in 2008.

Community banks, in contrast, have always been the largest group of HMDA reporters. In 2020, community banks were 1,918 strong and made up 44.5% of all HMDA reporters. However, we have seen a steady decline in the number of community banks over the past five years and prior, likely due to a combination of industry consolidation and changes to HMDA reporting thresholds. Perhaps due to their drop in number, community banks lost share of the purchase market in 2020, originating 14.4% of all home purchase loans – their lowest share on record. For refinances, their market share was flat at 12.4% in 2020, from 12.1% in 2019.

Credit unions also saw a drop in counts last year, though not as drastic as the community banks. Their downward trend, which has accelerated over the past five years, reached a low of 1,390 in 2020. Despite this drop, the credit unions’ share of HMDA reporters rose steadily over the same period, reaching a high of 32.3% last year. In terms of volume, credit unions are the most “stable” group and have consistently originated 4-6% of purchase loans and 7-9% of refinance loans since 2008. Both their 5.1% purchase share, and 7.0% refinance share, however, were at seven-year lows.

Non-depositories are a stable group in total and have simply skyrocketed in terms of market share. 874 non-depositories, representing one-fifth (20.3%) of HMDA reporters, originated almost two-thirds of both purchase and refinance loans in 2020. Their share of the purchase market climbed for the 12th consecutive year, from 26.6% in 2008 to 61.4% in 2020. Unlike for purchases, non-depositories’ growth in the refinance market has not been strictly upward; that said, their 64.5% share in 2020 is more than three times the 20.7% share they held in 2008.

MBA’s HMDA data analyses are limited to the following: 1-4 unit, closed-end (or exempt), first-lien loans originated through the retail/consumer direct, broker wholesale, or non-delegated correspondent channels, excluding home improvement loans and loans with “other” or “not applicable” purposes.

Click HERE to learn more about MBA’s HMDA data analyses and pre-order the 2021 HMDA Residential Originations and Executive Databooks.

–Jon Penniman (jpenniman@mba.org)