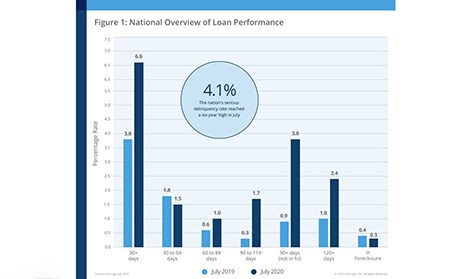

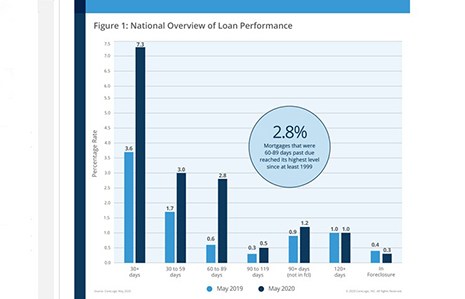

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

Tag: Frank Nothaft

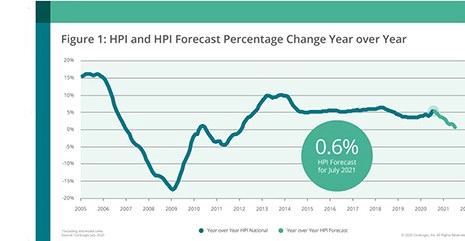

Home Price Appreciation Jumps to Six-Year High

CoreLogic, Irvine, Calif., said home prices increased 6.7% nationally in September 2020 compared with September 2019, the fastest annual acceleration since May 2014.

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

CoreLogic: U.S. Home Price Appreciation Jumps in August

Despite pandemic pressures, home prices increased 5.9 percent year-over-year in August, reported CoreLogic, Irvine, Calif.

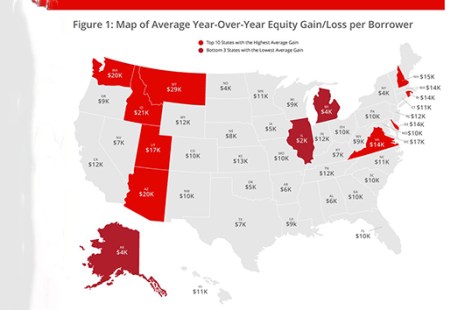

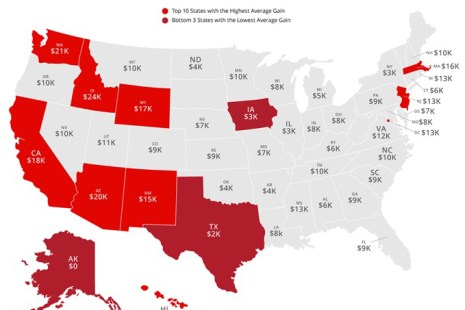

CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

‘Strong and Resilient:’ CoreLogic Home Price Index at 2-Year High

CoreLogic, Irvine, Calif., said its U.S. Home Price Index jumped to a 5.5% year-over-year increase in July, its highest level since 2018. Month over month, the Index rose by 1.2%.

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

CoreLogic: Mortgage Delinquencies Hit Downslope

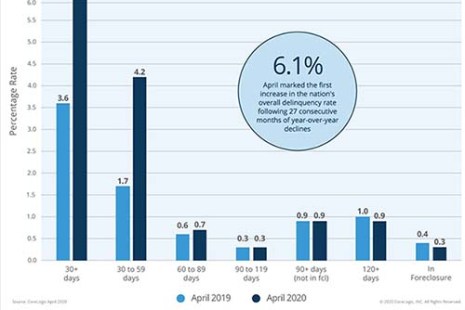

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

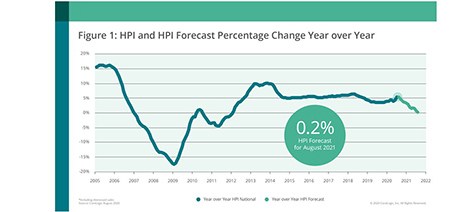

CoreLogic: Summer Home Price Cooldown on the Way

CoreLogic, Irvine, Calif., said home prices rose strongly in May, but warned that the effects of the coronavirus and subsequent economic downturn could send home price tumbling over the summer.

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.