CoreLogic: Despite Pandemic, Homeowners Gain $620 Billion in Equity

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

The report said despite a cool off in April, home-purchase activity remained strong in the second quarter as prospective buyers took advantage of record-low mortgage rates. This, coupled with constricted for-sale inventory, helped drive home prices up and add to borrower equity through June.

However, with unemployment expected to remain elevated throughout the remainder of the year, CoreLogic predicts home price growth will slow over the next 12 months and mortgage delinquencies will continue to rise. These factors combined could lead to an increase of distressed-sale inventory, which could put downward pressure on home prices and negatively impact home equity.

“The CoreLogic Home Price Index registered a 4.3% annual rise in prices through June, which supported an increase in home equity,” said CoreLogic Chief Economist Frank Nothaft. “In our latest forecast, national home price growth will slow to 0.6% in July 2021 with prices declining in 11 states. Thus, home equity gains will be negligible next year, with equity loss expected in several markets.”

“Homeowners’ balance sheets continue to be bolstered by home price appreciation, which in turn mitigated foreclosure pressures,” said Frank Martell, president and CEO of CoreLogic. “Although the exact contours of the economic recovery remain uncertain, we expect current equity gains, fueled by strong demand for available homes, will continue to support homeowners in the near term.”

The report said negative equity, also referred to as “underwater” or “upside down,” continued to fall in the second quarter:

–Quarterly change: From first quarter 2020 to the second quarter of 2020, the number of mortgaged homes in negative equity decreased by 5.4% to 1.7 million homes or 3.2% of all mortgaged properties.

—Annual change: A year ago, 2.1 million homes, or 3.8% of all mortgaged properties, were in negative equity. This number decreased by 15% in the second quarter to 1.7 million mortgaged properties in negative equity.

—National aggregate value: The national aggregate value of negative equity was fell to $284 billion at the end of the second quarter, by $0.7 billion (0.2%) from the first quarter and by $20 billion (6.6%) from a year ago.

CoreLogic said if home prices increase by 5%, 270,000 homes would regain equity; if home prices decline by 5%, 380,000 would fall underwater.

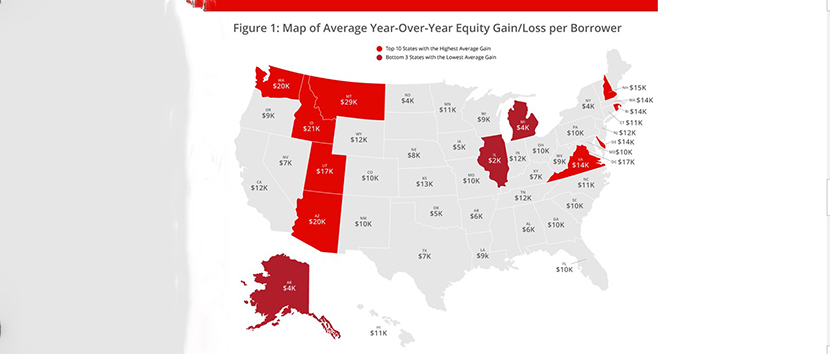

The report said while national figures reflect a resilient housing market thus far into the recession, equity gains varied broadly on the local level. States with strong home price growth have continued to experience the largest gains in equity. This includes Montana, where homeowners gained an average of $28,900; Idaho, where homeowners gained an average of $21,200 and Washington, where homeowners gained an average of $20,400. Meanwhile, New York, which was hit hard by the pandemic, experienced some of the lowest equity gains (averaging just $4,400) and highest negative equity shares in the second quarter.