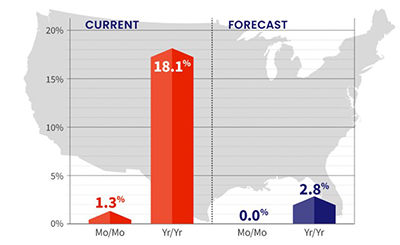

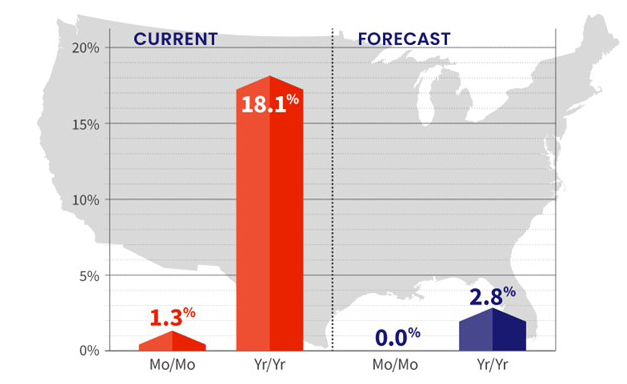

CoreLogic: Annual Home Price Appreciation Up 18.1%

While several recent reports suggest home price appreciation is decelerating, CoreLogic, Irvine, Calif., says the home-selling gravy train isn’t ending anytime soon.

The company’s monthly Home Price Index reported nationally, home prices increased by 18.1% in November from a year ago. Month over month, home prices increased by 1.3% from October. The report said annual appreciation of detached properties (19.4%) was 5.8 percentage points higher than that of attached properties (13.6%).

CoreLogic Chief Economist Frank Nothaft noted while 2021 was a record-breaking year for U.S. home price growth, for many prospective buyers the hot housing market will continue to exacerbate ongoing affordability challenges into the new year — and beyond. The report said though home price growth remains at historic highs, it is projected to slow over the next year, to 2.8 percent annual growth. However, economic growth and inflation will most likely lead to increases in mortgage rates, which will further erode affordability.

“Interest rates on 30-year fixed-rate mortgages averaged a record low of 2.96% during 2021, helping to keep monthly payments low in the face of record-high home prices,” Nothaft said. “However, the Federal Reserve appears poised to allow interest rates to rise in 2022. Higher rates will intensify buyer affordability challenges, especially in overvalued local markets.”

The report said Naples, Fla., logged the highest year-over-year home price increase at 36.7%, followed by Twin Falls, Idaho, at 33.3%.

At the state level, the Southeast and Mountain West regions continued to dominate the top spot, with Arizona showing strongest price growth at 28.6%. Florida ranked second at 25.8%, pushing Idaho from second to third place at 25.5%. “Over the past year, we have seen one of the most robust seller’s markets in a generation,” said Frank Martell, president and CEO of CoreLogic. “While increased interest rates may help cool down homebuying activity, we expect 2022 to be another strong year with continuing upward price growth.”