As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

Tag: First American Financial Corp.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

First American’s Mark Fleming: Why Higher Mortgage Rates Don’t Always Lead to Declining House Prices

House prices have remained resilient, even in the face of fast-rising mortgage rates. That’s because the relationship between rising mortgage rates and home prices may not be as straightforward as many believe.

Ksenia Potapov from First American: First-Time Home Buyer Affordability Outlook Mixed, but Affordable Markets Remain

The affordability outlook is mixed, but there are markets that remain affordable for the potential first-time home buyer, like Buffalo, Pittsburgh and Detroit, despite the turbulence of today’s housing market.

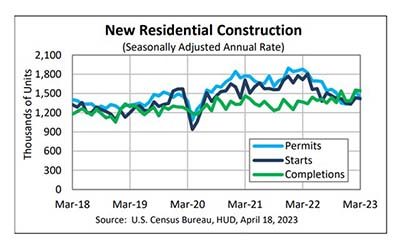

April Housing Starts Up 2.2%

Housing starts posted a modest increase in April, the Census Bureau and HUD reported Wednesday.

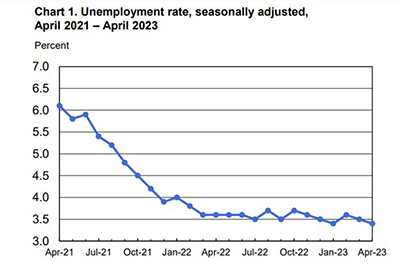

April Employment Beats Expectations

The U.S. economy added 253,000 jobs in April, and the unemployment rate fell again to match a 53-year low, beating analyst expectations, the Bureau of Labor Statistics reported Friday.

Housing Market Roundup Apr. 24, 2023

Here is a summary of housing market reports that have come across the MBA NewsLink desk:

March Housing Starts Down 1%; Single-Family Starts, Permits, Completions Up

Housing starts fell by 0.8 percent in March, the Census Bureau and HUD reported Tuesday, although single-family starts, permits and completions all rose amid growing home builder sentiment.