Black Knight, Jacksonville, Fla., said its McDash Flash Forbearance Tracker, as of May 19, reported 4.75 million homeowners – or 9.0% of all mortgages – have entered into COVID-19 mortgage forbearance plans. Active forbearance volumes increased by just 93,000 over the past week, a more than 70% decline from the 325,000 from the first week of May.

Tag: Fannie Mae

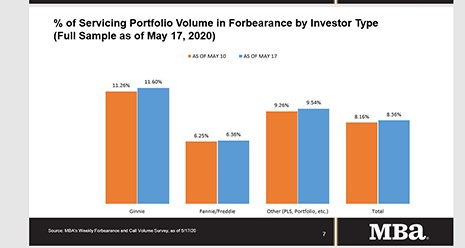

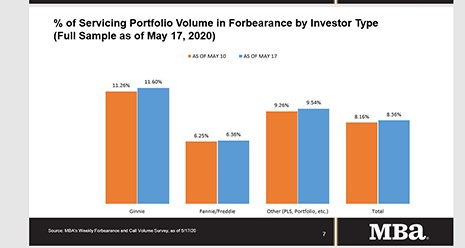

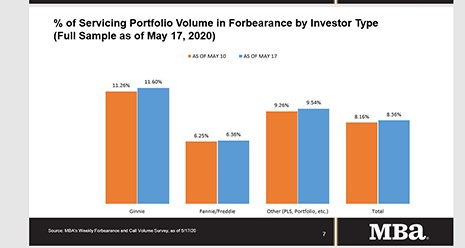

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Dealmaker: Arbor Funds $73M in Fannie Mae DUS Loans

Arbor Realty Trust, Uniondale, N.Y., funded $73.2 million in Fannie Mae Delegated Underwriting and Servicing loans in Texas and Kansas

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

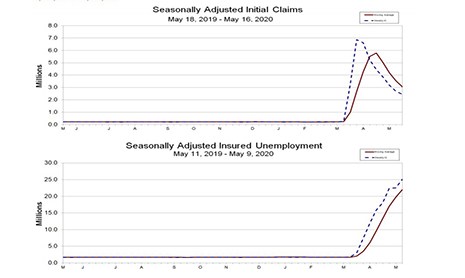

Labor Dept. Reports 2.4 Million New Jobless Claims; Total Now 38.6 Million

Another 2.4 million Americans filed initial jobless claims last week, the Labor Department reported yesterday, bringing to 38.6 million workers who have applied for unemployment assistance since the coronavirus pandemic clobbered the U.S. economy nine weeks ago.

MBA Mortgage Action Alliance ‘Call to Action’ Urges Support of House Bill Supporting Access to Credit

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” yesterday urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.

FHFA Re-Proposes Capital Rule to Move GSEs from Conservatorship

The Federal Housing Finance Agency issued a notice of proposed rulemaking that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac. The proposed rule is a re-proposal of the notice of proposed rulemaking published in July 2018.