Labor Dept. Reports 2.4 Million New Jobless Claims; Total Now 38.6 Million

Another 2.4 million Americans filed initial jobless claims last week, the Labor Department reported yesterday, bringing to 38.6 million workers who have applied for unemployment assistance since the coronavirus pandemic clobbered the U.S. economy nine weeks ago.

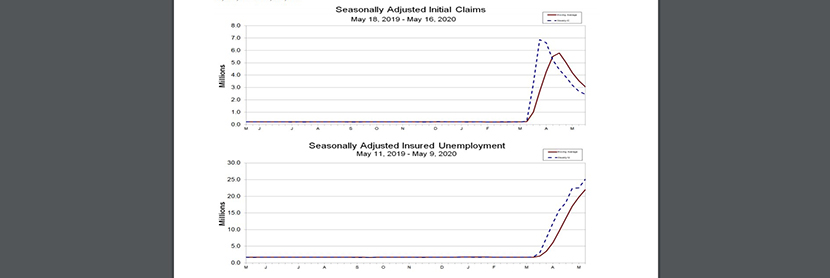

For the week ending May 16, Labor said the advance figure for seasonally adjusted initial claims came to 2.438 million, a decrease of 249,000 from the previous week’s revised level. The four-week moving average fell to 3.042 million, a decrease of 501,000 from the previous week’s revised average.

The report said the advance seasonally adjusted insured unemployment rate rose to 17.2 percent for the week ending May 9, an increase of 1.7 percentage points from the previous week’s revised rate. The previous week’s rate was revised down by 0.2 from

15.7 to 15.5 percent. The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 25.073 million, an increase of 2.525 million from the previous week’s revised level.

Labor reported the total number of people claiming benefits in all programs for the week ending May 2 rose to 27.264 million, an increase of 1.9 million from the previous week. A year ago, just 1.565 million people claimed benefits in all programs.

“When 2.4 million is good, you know things are bad,” said Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte N.C. “Just over 2.4 million people filed claims for unemployment last week. That is terrible. But amidst that misery, there is some hope: the number of people filing claims fell for the seventh straight week.”

Vitner noted at any other time in the past 50 years, news that so many Americans filed claims for unemployment insurance in a single week would be a “horrifying” development. “But in March and April we saw weekly figures that at times crested above six million, so today’s news that jobless claims fell to 2.438M after 2.687M last week is good news,” he said.

Vitner said with reopening underway, there is hope on the horizon. “As of this week, every state in the country has begun at least early phases of reopening,” he said. “That means over the course of the summer we will get a sense of whether or not that 78% share of displaced do in fact get themselves back on the payroll.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said the historically elevated level of claims continues to illustrate the “unprecedented degree” of labor market disruption being registered via reduced economic activity and falling consumer confidence due to the ongoing COVID-19 outbreak.

“As with the prior weeks, a few caveats make this week’s data difficult to interpret precisely,” Duncan said. “On one hand, unemployment insurance eligibility rules have been relaxed recently, increasing the number of people who are able to apply. This makes it difficult to estimate the uninsured unemployed share of the workforce. On the other hand, many states reported a significant backlog of unemployment insurance applications due to a lack of processing capacity, indicating that this week’s release may understate the true extent of insured layoffs.”