The Federal Housing Finance Agency yesterday published a Credit Risk Transfer spreadsheet tool based on the re-proposed capital rule for Fannie Mae and Freddie Mac.

Tag: Fannie Mae

Industry Briefs June 3, 2020

The Federal Housing Finance Agency released its latest report on the sale of non-performing loans by Fannie Mae and Freddie Mac. The report shows that, through December 31, 2019, the Enterprises sold 126,757 NPLs with a total unpaid principal balance of $23.8 billion.

Brent Chandler: Timely Employment Verification Pivotal to Mortgage, Other Consumer Lending Risk Management

Mortgage bankers and consumer lenders of every stripe have their plates full right now, so some may have missed a significant development or not had the bandwidth to consider its implications. One of America’s primary investors in loans to consumers has lost confidence in automated systems used for verifying loan applicants’ current employment status, accelerating an already-in-motion shift in how borrowers’ ability to repay needs to be assessed.

Brent Chandler: Timely Employment Verification Pivotal to Mortgage, Other Consumer Lending Risk Management

Mortgage bankers and consumer lenders of every stripe have their plates full right now, so some may have missed a significant development or not had the bandwidth to consider its implications. One of America’s primary investors in loans to consumers has lost confidence in automated systems used for verifying loan applicants’ current employment status, accelerating an already-in-motion shift in how borrowers’ ability to repay needs to be assessed.

Brent Chandler: Timely Employment Verification Pivotal to Mortgage and Other Consumer Lending Risk Management

Mortgage bankers and consumer lenders of every stripe have their plates full right now, so some may have missed a significant development or not had the bandwidth to consider its implications. One of America’s primary investors in loans to consumers has lost confidence in automated systems used for verifying loan applicants’ current employment status, accelerating an already-in-motion shift in how borrowers’ ability to repay needs to be assessed.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

FHFA Announces New Fannie Mae, Freddie Mac LIBOR Transition Resources

The Federal Housing Finance Agency yesterday announced Fannie Mae and Freddie Mac launched new websites that provide resources for lenders and investors as they transition away from the London Interbank Offered Rate.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

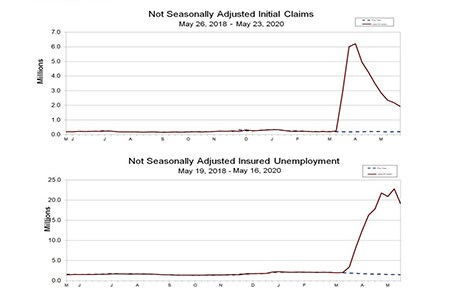

New Initial Claims at 2.1 Million; Total Claims Top 40 Million

American workers filed an additional 2.1 million initial claims last week, bringing the 10-week total for claims to nearly 41 million, the Labor Department reported yesterday.

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.