FirstClose Inc., Austin, Texas, a provider of technology platforms for banks and credit unions, partnered with Temenos, a banking software company. With integration of the FirstClose ONE platform into Temenos Infinity Loan Origination, customers can order instant and bundled reports on credit, flood, valuation, tax and title directly from the loan origination system.

Tag: Fannie Mae

Fannie Mae: Explore eClosing Scenarios

Did you know electronic closings can occur in different ways? Take a closer look at two digital closing scenarios: hybrid and full eClosing with remote online notarization (RON).

FHFA Extends GSE Loan Processing Flexibilities Through Aug. 31

The Federal Housing Finance Agency announced yesterday that Fannie Mae and Freddie Mac will extend several loan origination flexibilities until August 31 to ensure continued support for borrowers during the COVID-19 national emergency.

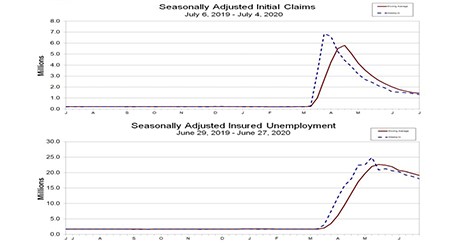

Unemployment Claims Top 1M for 16th Consecutive Week

The good news: initial claims fell for the 14th consecutive week, the Labor Department said yesterday. The bad news: despite the decrease, initial claims topped one million for the 14th consecutive week and look as if they will continue to do so for several more weeks.

Fannie Mae: Explore eClosing Scenarios

Did you know electronic closings can occur in different ways? Take a closer look at two digital closing scenarios: hybrid and full eClosing with remote online notarization (RON).

Housing Finance Market Roundup

Here’s a summary of recent reports about the housing market and real estate finance, with reports from Zillow; Veros Real Estate Solutions; Fannie Mae; Redfin; Genworth Mortgage Insurance; and Computershare Loan Services.

Fannie Mae: Explore eClosing Scenarios

Did you know electronic closings can occur in different ways? Take a closer look at two digital closing scenarios: hybrid and full eClosing with remote online notarization (RON).

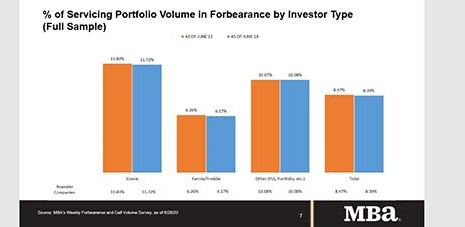

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Fannie Mae: Explore eClosing Scenarios

Did you know electronic closings can occur in different ways? Take a closer look at two digital closing scenarios: hybrid and full eClosing with remote online notarization (RON).

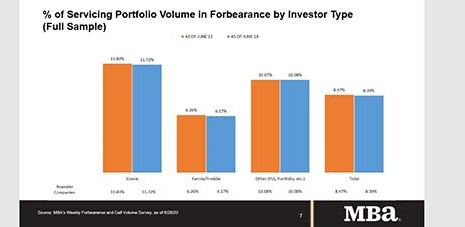

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.