Unemployment Claims Top 1M for 16th Consecutive Week

The good news: initial claims fell for the 14th consecutive week, the Labor Department said yesterday. The bad news: despite the decrease, initial claims topped one million for the 14th consecutive week and look as if they will continue to do so for several more weeks.

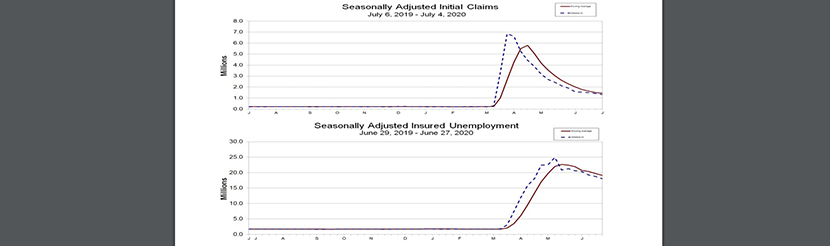

The report said for the week ending July 4, the advance figure for seasonally adjusted initial claims fell to 1,314,000, a decrease of 99,000 from the previous week’s revised level. The four-week moving average fell to 1,437,250, a decrease of 63,000 from the previous week’s revised average.

Labor said the advance seasonally adjusted insured unemployment rate fell to 12.4 percent for the week ending June 27, a decrease of 0.5 percentage point from the previous week’s revised rate. The advance number for seasonally adjusted insured unemployment—also known as continued claims—during the week ending June 27 decreased to 18,062,000, a decrease of 698,000 from the previous week’s revised level. The four-week moving average dropped to 19,085,500, a decrease of 636,000 from the previous week’s revised average.

Before the economic effects of the coronavirus, initial claims were running at roughly 200,000 per week.

Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C., noted first-time unemployment claims fell slightly more than expected during the week ended July 4. Declines were even seen in states facing sharp rises in COVID-19 cases.

“The lows in jobless claims are not a useful benchmark as to whether the labor markets has returned to normal,” Quinlan said. “A normal level of claims in an economy this size is likely somewhere between 300,000 and 350,000—or about one million below the current level. In short, we still have quite a bit a way to go to get back to ‘normal.’”

Quinlan noted, however, the improvement in continuing claims and drop the insured unemployment rate “suggest that we could see another solid employment report, when the July data are report on August 7.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., agreed. “[The] unemployment insurance report highlights that the labor market, while gradually improving, still faces a significant degree of disruption as a direct result of the ongoing COVID-19 outbreak,” he said. “Despite falling from a peak of 6.9 million on March 28, initial claims are still double the highest value seen during the previous recession. Furthermore, the pace of decline appears to have slowed in recent weeks. Over the last 15 weeks, more than 46 million unemployment insurance claims have been filed.”