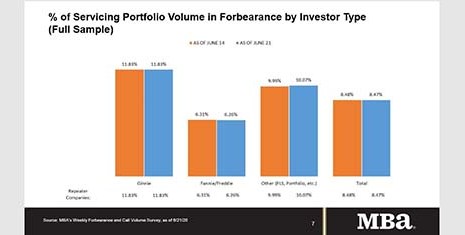

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Tag: Fannie Mae

Industry Briefs July 7, 2020

CoreLogic, Irvine, Calif., launched OneHome, a virtual, collaborative platform for real estate agents and their clients looking to buy, sell or make improvements to a home. Following a launch with Ohio-based Yes-MLS, OneHome is expected to be nationally available by the end of 2020 to the more than 850,000 real estate agents in North America who currently use CoreLogic’s multiple listing platform.

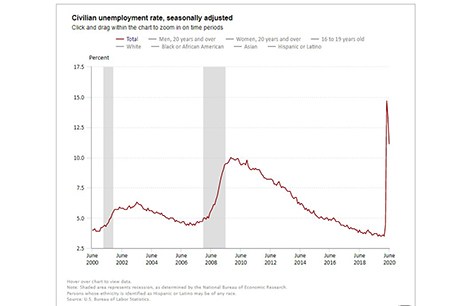

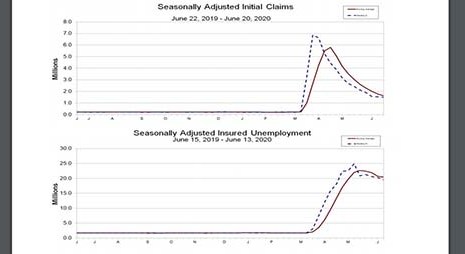

June Jobs Up Nearly 5 Million; Unemployment Rate Drops; New Claims at 1.4 Million

The Bureau of Labor Statistics reported total nonfarm payroll employment jumped by 4.8 million in June, as easing of coronavirus restrictions brought back more workers who had been laid off earlier this spring.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency on Monday announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

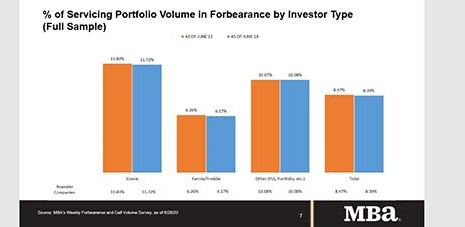

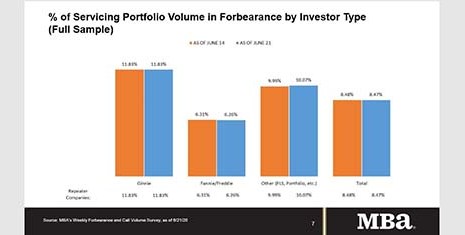

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Industry Briefs June 30, 2020

Roostify, San Francisco, announced a partnership with Factual Data as part of an expansion that will allow loan officers to run borrower credit and view findings within the Roostify platform.

Initial Claims Level Again at 1.5 Million

American workers filed 1.5 million new applications for jobless benefits last weeks, the Labor Department reported Friday—the third consecutive week at that level, but still at historically high levels in the wake of the coronavirus pandemic.

May New Home Sales Post Healthy 16.6% Gain

Home buyer enthusiasm for new homes intensified in May, HUD and the Census Bureau reported yesterday, jumping by 16.6 percent from April and by nearly 13 percent from a year ago.