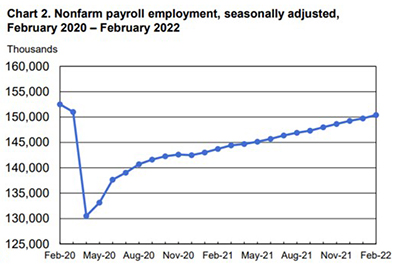

For the second straight month, employment numbers beat expectations, with the Bureau of Labor Statistics reporting Friday that employment rose by 678,000 in February.

Tag: Fannie Mae

Mark Walser of Incenter Appraisal Management on Desktop Appraisal Developments

Mark Walser is President of Incenter Appraisal Management, Charlotte, N.C., a national AMC and creator of the RemoteVal remote/desktop appraisal technology platform.

FHFA Issues Final Rule Amending GSE Regulatory Capital Framework

The Federal Housing Finance Agency published a final rule that amends the Enterprise Regulatory Capital Framework by refining the prescribed leverage buffer amount and risk-based capital treatment of retained credit risk transfer exposures for Fannie Mae and Freddie Mac.

FHFA Re-Proposes Updated Eligibility Requirements for Enterprise Single-Family Seller/Servicers

The Federal Housing Finance Agency on Thursday re-proposed minimum financial eligibility requirements for Fannie Mae and Freddie Mac seller/servicers.

January New Home Sales Down 4.5%

January new home sales fell by 4.5% amid supply chain and inventory shortages, HUD and the Census Bureau reported Thursday.

Industry Briefs Feb. 18, 2022: Constellation Mortgage Solutions Acquires ReverseVision

Constellation Mortgage Solutions Inc., Southfield, Mich., acquired ReverseVision Inc., San Diego, a provider of Home Equity Conversion Mortgage and private reverse mortgage sales origination software.

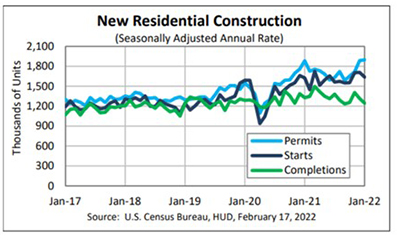

January Housing Starts Down 4.1%

Housing starts stumbled out the gate in January amid ongoing supply chain issues and labor shortages, HUD and the Census Bureau reported Thursday.

Industry Briefs Feb. 10, 2022: Insellerate Gets Capital Investment

Insellerate, Newport Beach, Calif., a provider of customer relationship management and marketing automation platforms to the mortgage lender and real estate industries, announced a strategic investment led by Argentum with participation from First Analysis.

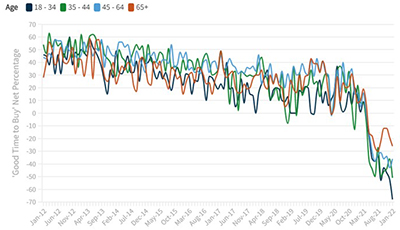

Younger Would-Be Home Buyers Increasingly Pessimistic

The Fannie Mae Home Purchase Sentiment Index fell to its lowest level since just after the start of the pandemic as affordability constraints, particularly involving younger home buyers, continued to weigh on the housing market.

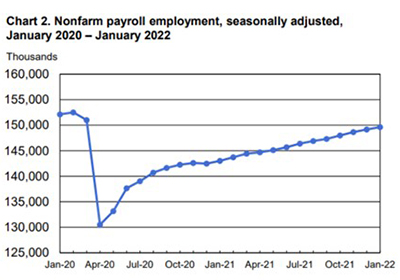

January Employment Shows Solid 467,000 Gain

For the first time in months, the Employment Report from the Bureau of Labor Statistics exceeded expectations: employers added 467,000 jobs in January, despite a surge in Omicron-variant coronavirus cases, BLS reported Friday.