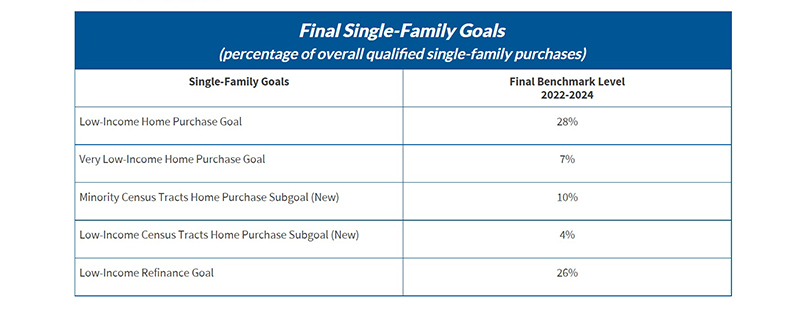

FHFA Finalizes 2022-2024 Single-Family, 2022 Multifamily Housing Goals

The Federal Housing Finance Agency released benchmark levels for Fannie Mae and Freddie Mac single-family housing goals for 2022 through 2024 and benchmark levels for multifamily housing goals for 2022.

The single-family home purchase goals include two new single-family home purchase subgoals, one targeting minority communities and the other targeting low-income neighborhoods. The new minority census tract subgoal is designed to improve access to fair and sustainable mortgage financing in communities of color. An enterprise mortgage purchase qualifies under the new subgoal if:

–the borrower has an income at or below area median income; and

–the property is in a census tract where the median income is at or below the area median income and where minorities make up at least 30 percent of the population.

FHFA noted the housing goals ensure the Enterprises promote equitable access to affordable housing that reaches low- and moderate-income families, minority communities and other underserved populations through their mortgage purchases.

“The Enterprises’ housing goals will support equitable access to sustainable, affordable housing opportunities in a safe and sound manner that bolsters the health of communities,” said FHFA Acting Director Sandra L. Thompson. “The new subgoals for minority and low-income census tracts will help preserve and support affordable housing opportunities as well as allow those communities to retain ownership of the neighborhoods they helped build.”

To meet a single-family housing goal or subgoal, the percentage of mortgage purchases by an Enterprise in that category must exceed either the benchmark level above or the market level for that year. The market level is determined retrospectively each year, based on Home Mortgage Disclosure Act data showing the actual goal-qualifying share of the overall market as measured by FHFA.

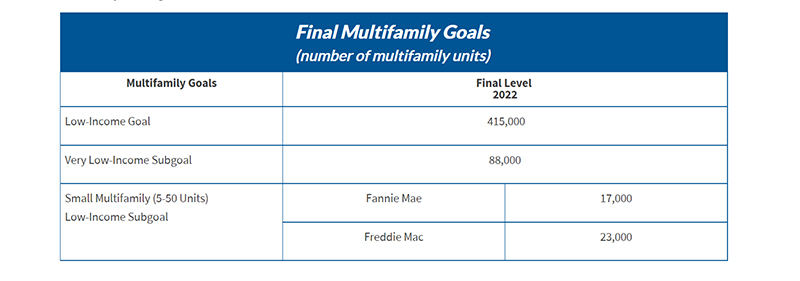

In response to public comments when the rule was first proposed and the differential impact of COVID-19 on various multifamily origination segments, FHFA noted the multifamily goals apply to 2022 only. The agency said it expects to engage in further rulemaking in 2022 to establish the multifamily benchmarks for 2023. The final rule also established different benchmark levels for Fannie Mae and Freddie Mac for the small multifamily low-income subgoal due in part to the Enterprise’s different business models.

“These benchmarks should continue to encourage the Enterprises’ participation in this market and ensure the Enterprises have the expertise necessary to serve this market should private sources of financing become unable or unwilling to lend on small multifamily properties,” FHFA said.

To meet a multifamily housing goal or subgoal, an Enterprise must purchase mortgages on multifamily properties with rental units affordable to families in each category. FHFA will measure Enterprise multifamily goals performance against the benchmark levels above.

By law, the Enterprises must support a stable and liquid national market for residential mortgage financing. FHFA establishes annual housing goals for the Enterprises and assesses their performance under the housing goals annually.