Housing Starts End Year on Positive Note

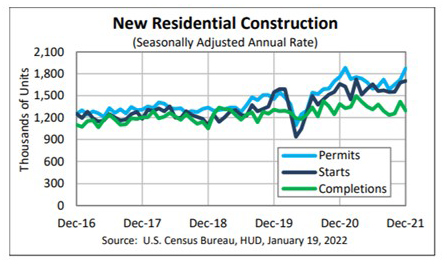

Housing starts posted a modest increase in December, HUD and the Census Bureau reported Wednesday, and jumped by nearly 16 percent from a year ago.

The report said privately owned housing starts in December rose to a seasonally adjusted annual rate of 1,702,000, 1.4 percent higher than the revised November estimate (1,678,000) and 2.5 percent higher than a year ago (1,661,000). Single‐family housing starts in December rose to 1,172,000; 2.3 percent below the revised November figure (1,199,000). The December rate for units in buildings with five units or more rose to 524,000, nearly 14 percent higher than November (461,000 units) and 56 percent higher than a year ago.

Regionally, results were mixed. In the largest region, the South, starts fell y 1.9 percent to 915,000 units in December, seasonally annually adjusted, from 933,000 units in November but improved by 9.3 percent from a year ago. In the West, starts fell by nearly 14 percent to 362,000 units in December from 420,000 in November and fell by 18.1 percent from a year ago.

In the Midwest, starts jumped by 36.5 percent in December to 288,000 units, seasonally annually adjusted, from 211,000 units in November and improved by 17.1 percent from a year ago. In the Northeast, starts rose by 20.2 percent in December to 137,000 units from 114,000 units in November and improved by 0.7 percent from a year ago.

The report said 1,595,100 housing units started in 2021, 15.6 percent higher than 2020 (1,379,600).

“Multifamily construction boosts housing starts above expectations, capping strong year for home construction,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Limited existing homes available for sale have made for a very competitive market. The market is ripe for homebuilders to ramp up new home construction to meet the growing demand. This month’s 6.5% year-over-year increase in permits is a welcome sign of new inventory to come.”

Kushi noted housing demand has outstripped supply since 2009. “Builders are entering 2022 with backlogs they are having a hard time completing due to material and labor shortages,” she said. “The shortage of skilled labor, materials and lots, are headwinds to increasing the pace of new construction. The good news in the December housing starts report is the number of single-family homes permitted, but not started declined to its lowest level since April 2021, but remains elevated compared to pre-pandemic.”

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., said milder than usual weather allowed more construction to take place in what is normally a seasonally slow month. “Home building finished 2021 on a high note and appears to have strong momentum headed into the new year,” he said. “That marks the best year for single-family starts since 2006. Multifamily starts rose 21.3% this past year to 472,000 units, marking their best year since 1987.”

“It’s encouraging that single-family home completions rose for the second continuous month to the highest pace since April 2021 after treading water for most of last year,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “We anticipate that the combination of more new homes being completed and higher mortgage rates weighing on purchase demand will begin to bring more balance between supply and demand in the coming quarters, coinciding with our forecast of decelerating home price growth for 2022.”

The report said privately owned housing units authorized by building permits in December rose to a seasonally adjusted annual rate of 1,873,000, 9.1 percent above the revised November rate of 1,717,000 and 6.5 percent above the December 2020 rate of 1,758,000. Single‐family authorizations in December rose to 1,128,000; 2.0 percent above the revised November figure of 1,106,000. Authorizations of units in buildings with five units or more rose to 675,000 in December, 2 percent higher than November (563,000 units) and nearly 42 percent higher than a year ago.

The report estimated 1,724,700 housing units authorized by building permits in 2021, 17.2 percent above the 2020 figure of 1,471,100.

Privately owned housing completions in December fell to a seasonally adjusted annual rate of 1,295,000, 8.7 percent below the revised November estimate of 1,418,000 and 6.6 percent below the December 2020 rate of 1,386,000. Single‐family housing completions in December rose to 990,000, 3.9 percent above the revised November rate of 953,000. The December rate for units in buildings with five units or more fell to 299,000, 34.3 percent lower than November (455,000 units) and 28 percent lower than a year ago.

The report estimated 1,337,800 housing units completed in 2021, 4.0 percent above the 2020 figure of 1,286,900.

On Thursday, the Mortgage Bankers Association releases its monthly Builder Applications Survey (see related story this issue) and the National Association of Realtors releases its monthly Existing Home Sales report for December. On Tuesday, Jan. 24, the S&P CoreLogic Case-Shiller Home Price Indexes come out; and on Wednesday, Jan. 26, HUD/Census releases its monthly New Residential Sales report for December.