FHFA: GSE Delinquency Rate Falls to 1.55%

The Federal Housing Finance Agency released its third quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 180,566 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,210,485 since the start of conservatorships in September 2008.

The report also said 43 percent of loan modifications completed in the third quarter reduced borrowers’ monthly payments by more than 20 percent. Refinances decreased from 1.614 million in the second quarter to 1.286 million in the third quarter.

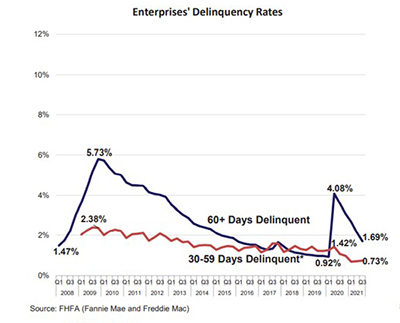

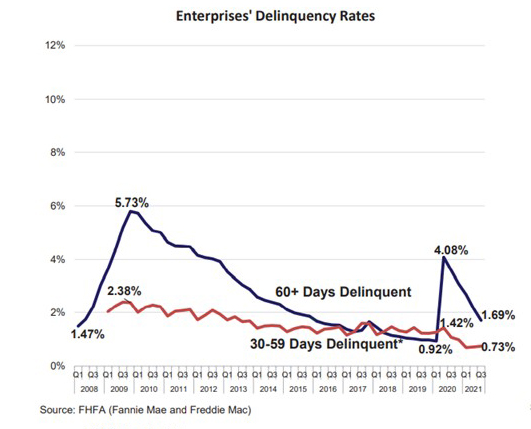

The report said the Enterprises’ serious delinquency rate dropped from 1.99 percent to 1.55 percent at the end of the quarter, compared to 8.19 percent for FHA loans, 4.48 percent for VA loans and 3.40 percent for all loans (industry average).

Other report findings

–Loans in forbearance plans continued to trend downward since its peak in May, as initiated forbearance plans decreased but remained elevated through the third quarter compared to pre-pandemic levels. As of September 30, FHFA reported 320,009 loans in forbearance, representing 1.07% of the Enterprises’ single-family conventional book of business, down from 490,508 or 1.65% at the end of the second quarter.

–The 60+ days delinquency rate dropped from 2.14 percent at the end of the second quarter to 1.69 percent at the end of the third quarter. The delinquency rates remained much higher than pre-coronavirus rates due to the forbearance programs offered to borrowers affected by the pandemic.

–Foreclosure starts increased by 16 percent to 7,253, while third-party and foreclosure sales rose 11 percent to 2,534 in the third quarter.

–The Enterprises’ REO inventory increased by 2 percent from 7,840 in the second quarter to 8,001 in the third quarter, as REO acquisitions outpaced property dispositions. Property acquisitions increased by 13 percent to 1,358, while dispositions decreased 35 percent to 1,197 during the quarter.