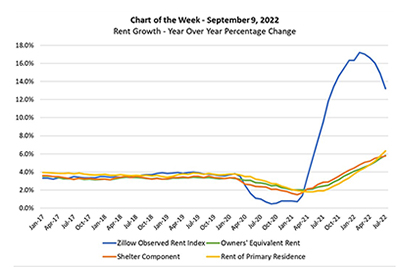

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?

Tag: Edward Seiler

MBA Chart of the Week: Rent Growth–Year-over-Year Percentage Change

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?

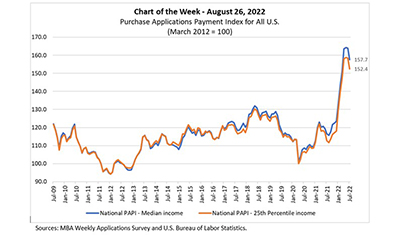

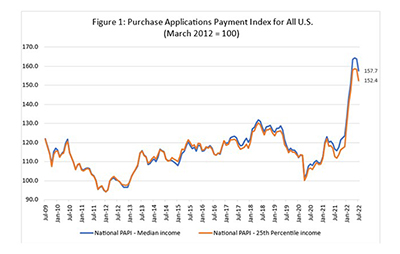

MBA Chart of the Week, Aug. 26, 2022: MBA Purchase Applications Payment Index

In this MBA Chart of the Week, we examine how market transitions are affecting homebuyer affordability.

MBA Chart of the Week, Aug. 26, 2022: MBA Purchase Applications Payment Index

In this MBA Chart of the Week, we examine how market transitions are affecting homebuyer affordability.

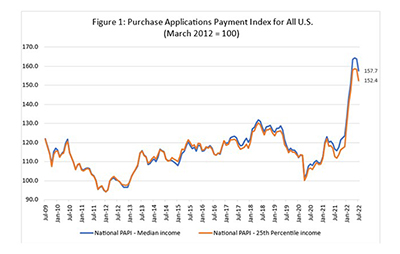

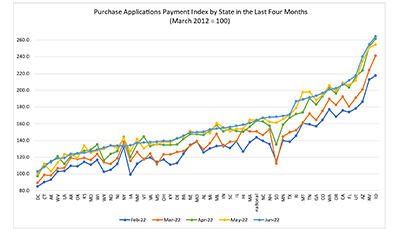

MBA: Lower Mortgage Rates, Loan Amounts Improve July Homebuyer Affordability in 47 States

Homebuyer affordability improved for the second straight month in July, with the national median payment applied for by applicants decreasing to $1,844 from $1,893 in June, the Mortgage Bankers Association reported Wednesday.

MBA: Lower Mortgage Rates, Loan Amounts Improve July Homebuyer Affordability in 47 States

Homebuyer affordability improved for the second straight month in July, with the national median payment applied for by applicants decreasing to $1,844 from $1,893 in June, the Mortgage Bankers Association reported Wednesday.

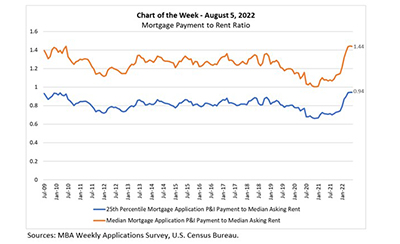

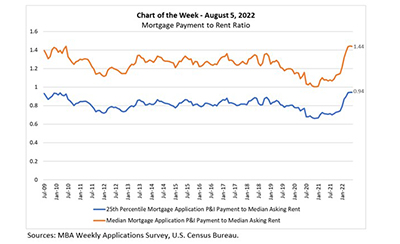

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

MBA: Mortgage Application Payments Hold Steady Despite Higher Rates

Homebuyer affordability was mostly unchanged in June, with the national median payment applied for by applicants down slightly to $1,893 from $1,897 in May, the Mortgage Bankers Association’s Purchase Applications Payment Index reported.

Who Owns Climate Risk? MBA White Paper Examines Challenges, Risks for U.S. Real Estate

The Mortgage Bankers Association this week issued a white paper examining how climate change is dramatically reshaping lenders’ and policymakers’ approaches to the U.S. real estate market.