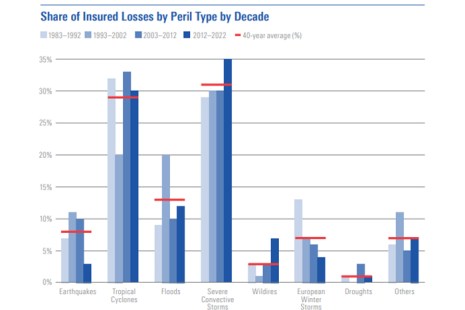

DBRS Morningstar, Toronto, released a new analysis warning about the impacts of climate change–including hurricanes–on property insurance in vulnerable areas. Insurance companies are exiting catastrophe-prone areas, DBRS Morningstar said, potentially leading to a decline in property values.

Tag: DBRS Morningstar

DBRS Morningstar: CMBS Delinquency Rate Surges

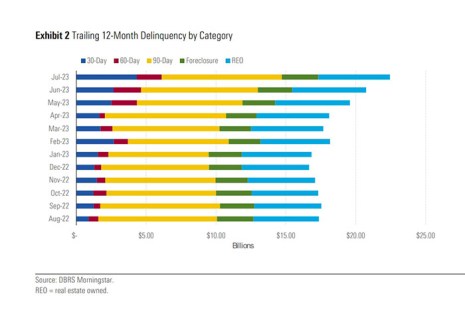

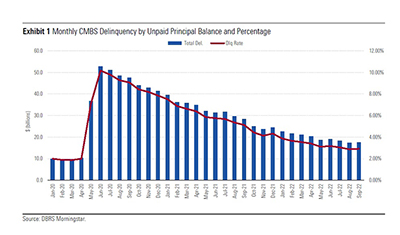

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

CMBS Delinquency, Special Servicing Rates Increase

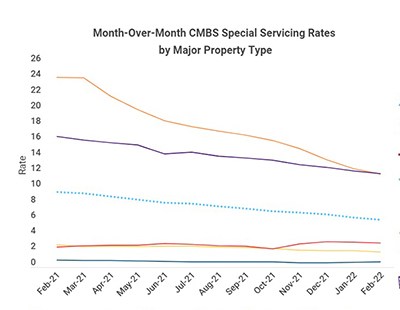

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.

CMBS Delinquency Rate Rises

DBRS Morningstar, New York, said the delinquency rate for loans packaged in commercial mortgage-backed securities rose in September for just the third time since mid-2020.

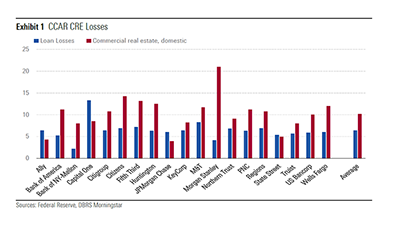

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

Tenant Quality Makes a Difference

Commercial real estate tenant quality grows even more important in a recessionary environment, reported DBRS Morningstar, Toronto.

DBRS Morningstar: Solid Credit Performance for Non-QM RMBS

The credit performance of residential mortgage-backed securities backed by non-Qualified Mortgage loans rated by DBRS Morningstar remained steady in the first half of 2022, the ratings firm reported.

CMBS Delinquency Rate Maintains Downward Trajectory

The commercial mortgage-backed securities delinquency rate fell 10 basis points during March to 2.38 percent, driven by robust new issuance and few new delinquencies, reported Fitch Ratings, New York.

DBRS: Hotel Pandemic Distress Less Than Prior Downturns

COVID-19 hit the hotel sector hard. DBRS Morningstar, Toronto, reported hotels had the highest loan modification rate among major property sectors due to the pandemic but said liquidations were lower than prior downturns.

CMBS Delinquency, Special Servicing Rates Fall

The commercial mortgage-backed securities delinquency and special servicing rates both fell in February, analysts reported.