First American Financial Corp., Santa Ana, Calif., signed an agreement for its acquisition of Mother Lode Holding Co., a California-based provider of title insurance, underwriting and escrow services for residential and commercial real estate transactions with 17 operating subsidiaries throughout the U.S., including its principal subsidiary Placer Title Co.

Tag: DBRS Morningstar

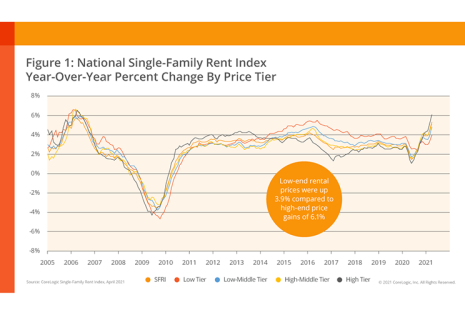

Single-Family Rent Growth Exceeds Pre-Pandemic Rates

Rent growth in single-family rental properties now exceeds pre-pandemic rates across all price tiers, including low-end rentals for the first time, reported CoreLogic, Irvine, Calif.

Banks Trimming Branches, Creating Empty Retail Storefronts

Bank mergers and increasing online banking have led to numerous bank branch closings in recent years, which could have a “profound” effect on commercial real estate, said DBRS Morningstar, Toronto.

CMBS Delinquency Rate Declines for Third Straight Month

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 14 basis points in January to 4.55 percent due to a slowing pace of new delinquencies and strong new issuance.

The Wonder Years: Freddie Mac’s K Series Turns 11

Freddie Mac’s K series quietly holds a place as an important, innovative multifamily market solution that has served borrowers, lenders, tenants and bondholders extremely well since its inception. Importantly for a government-sponsored entity, it also serves as a mechanism to transfer risk away from taxpayers.

Ratings Agency Seeks Better CRE Lending Disclosures

Better disclosures would allow rating agencies to better assess commercial real estate credit risk in bank loan portfolios, said DBRS Morningstar, Toronto.

Report Sees Potential Single-Family Rental Headaches

Single-family rental property fundamentals remain healthy, but there could be trouble on the horizon.

Coronavirus Triggers ‘Fundamental Rethinking’ of Office Market

DBRS Morningstar, Chicago, said the COVID-19 pandemic could spark a “fundamental rethinking” of the open office concept and accelerate the move toward more flexible working arrangements.

Industry Briefs

The Consumer Financial Protection Bureau issued a Supplemental Notice of Proposed Rulemaking regarding collection of time-barred debt.