At a time when the world is dealing with COVID-19—economic, political, social, medical, personal and even spiritual—it is up to financial services organization leadership to look forward to the lasting impacts on banking and finance. Innovation breadth during times of great crisis will not be challenged, and the operating result will be a very foreign landscape to those anticipating minimal post-crisis adjustments.

Tag: Coronavirus

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

With concerns surrounding coronavirus sending shockwaves throughout the U.S. and global economies, mortgage companies would be well advised to add pandemics to their list of events that could disrupt normal operations, as this specific type of incident poses unique challenges.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage.

CMBS Report: More Than 2,600 U.S. CMBS Borrowers Seek Coronavirus Relief; Delinquency Reports Mixed

Fitch Ratings, New York, reported more than 2,600 commercial real estate borrowers, representing $49.1 billion of mortgage loans, have sought potential debt relief during the first two weeks of the U.S. coronavirus outbreak.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage. However, with concerns surrounding coronavirus sending shockwaves throughout the U.S. and global economies, mortgage companies would be well advised to add pandemics to their list of events that could disrupt normal operations, as this specific type of incident poses unique challenges.

Mortgage Applications Down in MBA Weekly Survey

Mortgage application activity took a hit last week as the housing market continued to struggle with the effects of the coronavirus pandemic, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending April 3.

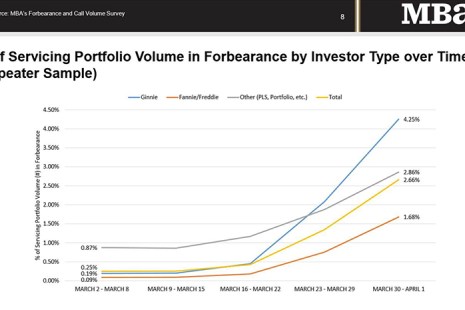

MBA Survey Shows Spikes in Loan Forbearance, Servicer Call Volumes

New survey findings from the Mortgage Bankers Association highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

MBA Takes Issue with Calabria’s Downplay of Need for Servicer Liquidity Facility

The Mortgage Bankers Association called “troubling” comments by Federal Housing Finance Agency Director Mark Calabria in which he dismissed the immediate need for a federally backed liquidity facility to assist mortgage servicers with forbearance efforts resulting from the coronavirus pandemic.