The longest economic expansion in U.S. history has likely come to an end amid the unprecedented impacts of COVID-19, according to the Fannie Mae Economic and Strategic Research Group.

Tag: Coronavirus

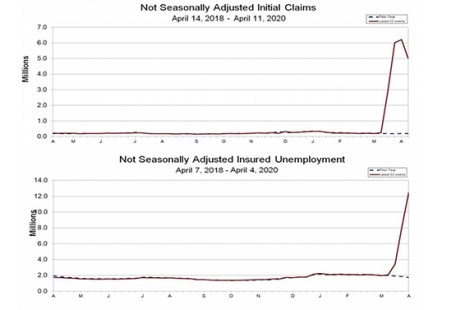

Another 5.2 Million Fill for Unemployment; 4-Week Total Rises to 22 Million

The Labor Department reported a seasonally adjusted 5.245 million people filed initial unemployment claims for the week of ending April 11, marking the fourth consecutive week of multi-million claims and bringing total claims filed in the past four weeks to more than 22 million.

OCC Issues Guidance on FEMA/Flood Insurance Force-Place Requirements

The Office of the Comptroller of the Currency on Wednesday provided guidance to the Mortgage Bankers Association, addressing conflicts between a recent Federal Emergency Management Agency memo and banking agency flood insurance rules.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

ATTOM: March Foreclosure Report Reflects Calm Before the Storm

ATTOM Data Solutions, Irvine, Calif., released its quarterly U.S. Foreclosure Market Report, which showed 156,253 U.S. properties with a foreclosure filing during the first quarter, up 42 percent from the previous quarter but down 3 percent from a year ago.

Federal Agencies Allow Member Banks to Postpone Appraisals for 120 Days

Three federal agencies this week announced a rule change allowing its member banks to postpone an appraisal on a residential or commercial property for 120 days after the loan is closed.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.

Mortgage Applications Up as Interest Rates Hit Record Low in MBA Weekly Survey

Mortgage applications increased from one week earlier as the 30-year fixed interest rate fell to the lowest level in survey history, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending April 10.

Mortgage Applications Up as Interest Rates Hit Record Low in MBA Weekly Survey

Mortgage applications increased from one week earlier as the 30-year fixed interest rate fell to the lowest level in survey history, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending April 10.

Mark P. Dangelo: Are Bankers Necessary? Part 2

At a time when the world is dealing with COVID-19—economic, political, social, medical, personal and even spiritual—it is up to financial services organization leadership to look forward to the lasting impacts on banking and finance. Innovation breadth during times of great crisis will not be challenged, and the operating result will be a very foreign landscape to those anticipating minimal post-crisis adjustments.