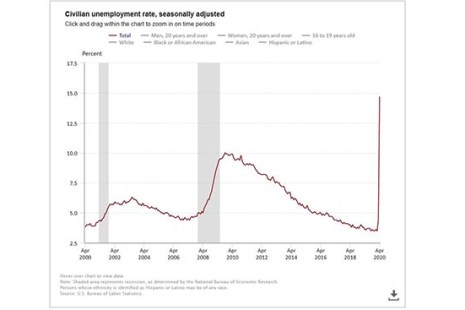

One of the worst weeks in U.S. economic history ended Friday with the Bureau of Labor Statistics reporting a staggering 20.5 million jobs lost in April and the unemployment rate jumping to its highest level since the Great Depression.

Tag: Coronavirus

Scott Roller: Remote Online Notarization – Navigating the Icebergs

Necessity is the mother of all invention, so the saying goes. No, not exactly true here. RON was already being deployed in pockets across the industry pre-coronavirus. Therefore, its more appropriate to proclaim, “perplexing problems produce instant popularity where past procrastination persisted.” Said more plainly – nothing is more white-hot than RON right now, and everyone suddenly cannot live without it. Demand far-outstrips supply by a factor too large to contemplate.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

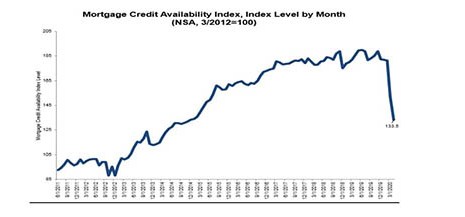

Mortgage Credit Availability Falls to 6-Year Low

Mortgage credit availability fell sharply in April for the second straight month, to a six-year low, the Mortgage Bankers Association reported Thursday.

Mortgage Credit Availability Falls to 6-Year Low

Mortgage credit availability fell sharply in April for the second straight month, to a six-year low, the Mortgage Bankers Association reported this morning.

Mortgage Applications Up Slightly in MBA Weekly Survey

Mortgage applications edged up slightly from a week earlier as the 30-year fixed interest rate fell to another record low, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending May 1.

Mortgage Applications Up Slightly in Latest MBA Weekly Survey

Mortgage applications edged up slightly from a week earlier as the 30-year fixed interest rate fell to another record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending May 1.

FHFA Extends Loan Processing Flexibilities for GSE Customers; Offers Tools for Renter Protection

The Federal Housing Finance Agency yesterday extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 pandemic. FHFA also announced the government-sponsored enterprises have created online multifamily property lookup tools designed to assist renters in learning about eviction protections.

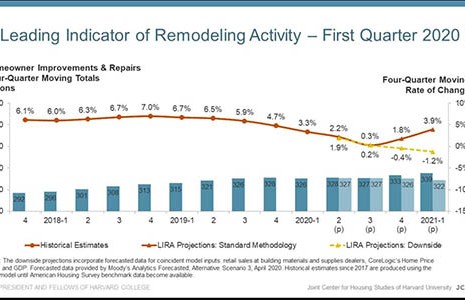

For Remodeling Market Outlook, an ‘Abrupt About-Face’

The coronavirus pandemic is taking its toll on many sectors of the housing market—and according to the Joint Center for Housing Studies of Harvard University, the previously solid home remodeling market is about to take a hit as well.

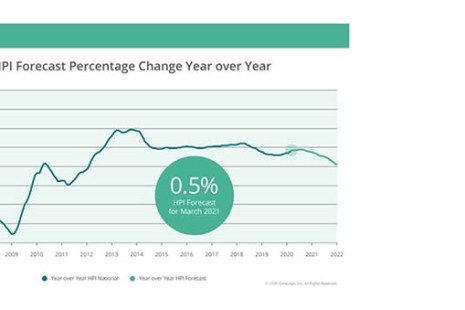

Home Prices Up For Now; Analysts See Slowdown

Two new home price reports speak to the new sense of volatility caused by the coronavirus pandemic.