For Remodeling Market Outlook, an ‘Abrupt About-Face’

The coronavirus pandemic is taking its toll on many sectors of the housing market—and according to the Joint Center for Housing Studies of Harvard University, the previously solid home remodeling market is about to take a hit as well.

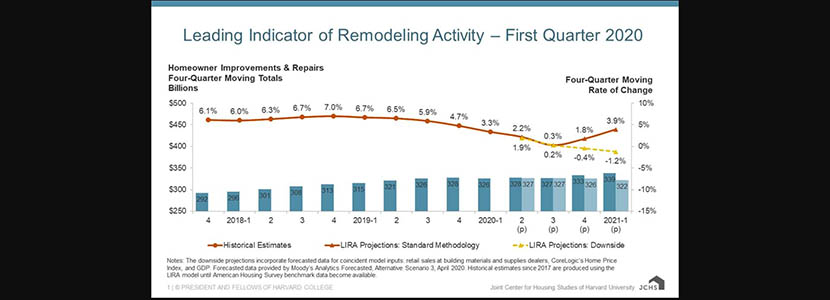

The Center’s quarterly Leading Indicator of Remodeling Activity said owner expenditures for home renovations and repairs are expected to decline at least through the first quarter of next year due to fallout from the COVID-19 pandemic.

Pre-pandemic, the LIRA pointed to a healthy rebound in home remodeling spending with annual growth of 3.9 percent by first quarter 2021. But Chris Herbert, Managing Director of the Joint Center, said latest data incorporating both actual and forecasted impacts of the economic shutdown point to spending declines this year with further worsening into 2021.

“While there is still considerable uncertainty surrounding the near- and longer-term impacts of the pandemic, the best available evidence suggests substantial downturns in key remodeling indicators of new home construction, home sales and values of existing homes over the coming quarters,” Herbert said. “Homeowners who are concerned about losses of income, home equity and other forms of wealth are anxious about making large investments in improving their homes in this economic environment.”

With “unprecedented changes” to the U.S. economy since mid-March, forecast provides a downside range for the home remodeling outlook, which incorporates forecasts for several core model inputs—retail sales of building materials, home prices and GDP.

“Quarterly spending for improvements and repairs to the owner-occupied housing stock is projected to turn negative by the third quarter, and annual expenditures are expected to fall to $322 billion by early next year with potential for even more severe declines to follow,” said Abbe Will, Associate Project Director in the Remodeling Futures Program. “Beyond the start of next year, remodeling activity that would typically result from expanding homebuilding, sales of existing homes, and home prices mean the greatest downturn could come later in 2021 with recovery depending on what occurs in housing markets over the remainder of this year.”

The Joint Center also projected expenditures for home improvements to the owner-occupied housing stock to decline in most of the nation’s largest metropolitan areas this year in response to the severe economic impacts of the COVID-19 pandemic.

Even before the pandemic hit, nearly all of the 47 tracked metros were expected to see slowdowns in improvement spending through 2020 as generated by the Center’s standard methodology projections, with growth of 1-5 percent expected in 37 metros and declines in only 9 metros. Revising these projections based on the estimated effect of the pandemic on national remodeling spending, the COVID-adjusted projections show annual homeowner remodeling spending will likely contract in the majority of metros (24), while only 15 could still see gains (1-3 percent), relative to 2019 activity.

“With the pandemic exacerbating localized slowdowns in house prices, existing home sales, and homebuilding, many metros will see even more pronounced erosion of home renovation activity this year,” Will said. “The largest remodeling spending declines are not isolated to any one region, but are projected to occur in markets throughout the country including Orlando, Kansas City, Omaha, San Jose and Portland.”

The Joint Center said with the country still in the early stages of the COVID-19 pandemic, there is “substantial uncertainty” about how long the economic downturn will last and how quickly a recovery will take hold. “As more and more data become available, we will continue to provide insights and analysis for understanding the varied impacts of the pandemic on local and regional home improvement activity,” Will said.

Meanwhile, the National Association of Home Builders Remodeling Market Index stood at 48, indicating more remodelers view conditions as unfavorable. .

“The impact of COVID-19 is visible in the remodeling industry,” said NAHB Remodelers Chair Tom Ashley Jr., a remodeler from Denham Springs, La. “The rate of inquiries coming in is slowing down because many home owners are wary of remodeling crews inside their homes.”

The new RMI survey asks remodelers to rate five components of the remodeling market as “good,” “fair” or “poor.” Each question is measured on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

The Current Conditions Index averaged 58, with large remodeling projects ($50,000 or more) yielding a reading of 53, moderately-sized remodeling projects (at least $20,000 but less than $50,000) at 59 and small remodeling projects (under $20,000) with a reading of 62.

The Future Indicator Index averaged 39, with the rate at which leads and inquiries are coming in at 30 and the backlog of remodeling jobs stands at 47.

From three months ago, remodelers said conditions fell to 24, indicating that many more remodelers thought conditions had become worse in the first quarter than thought they had become better.

“The low reading of 24 when comparing to the previous quarter is directly related to COVID-19,” said NAHB Chief Economist Robert Dietz. “With unemployment increasing and leads decreasing, the economic impacts of the pandemic are evident in the remodeling industry.”