Mortgage applications, buoyed by strong purchase application activity and stable, low interest rates increased from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending May 22.

Tag: Coronavirus

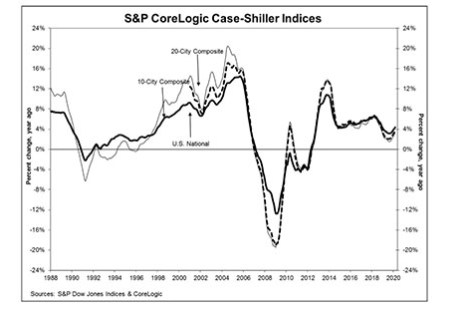

March Home Prices Up to 4.4% Annually

S&P Dow Jones Indices, New York, said its CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S.

Consumer Confidence Stabilizes After Spring Freefall

Consumers took a deep breath in May, and it showed. The Conference Board, New York, reported its Consumer Confidence Index held steady in May, following sharp declines in March April that saw it drop to its lowest level in six years.

Josh Friend: Engagement is Critical During Challenging Times

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

Mortgage Vendor News & Views With Scott Roller

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. The theme for today’s article is a unique set of circumstances that is enlisting homeowners to be an active participant within the appraisal process during the pandemic – and likely into the future.

Josh Friend: Engagement is Critical During Challenging Times

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

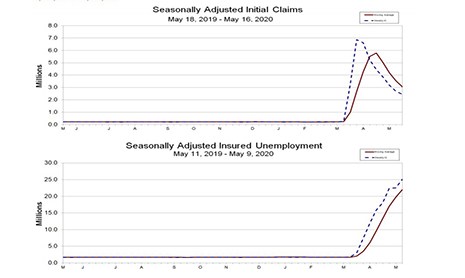

Labor Dept. Reports 2.4 Million New Jobless Claims; Total Now 38.6 Million

Another 2.4 million Americans filed initial jobless claims last week, the Labor Department reported yesterday, bringing to 38.6 million workers who have applied for unemployment assistance since the coronavirus pandemic clobbered the U.S. economy nine weeks ago.

MBA Mortgage Action Alliance ‘Call to Action’ Urges Support of House Bill Supporting Access to Credit

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” yesterday urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.