March Home Prices Up to 4.4% Annually

S&P Dow Jones Indices, New York, said its CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S.

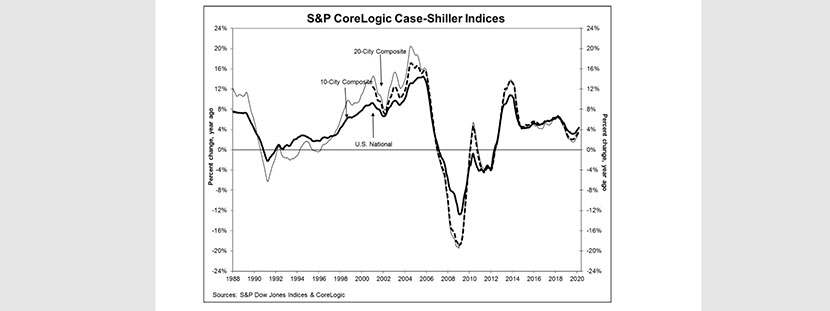

The National Home Price NSA Index reported a 4.4% annual gain in March, up from 4.2% in February. The 10-City Composite annual increase came in at 3.4%, up from 3.0% in February; the 20-City Composite (excluding Detroit, whose data were not ready) posted a 3.9% year-over-year gain, up from 3.5% in February.

Phoenix led with an 8.2% year-over-year price increase, followed by Seattle at 6.9% and Charlotte at 5.8% increase. Seventeen of the 19 cities reported higher price increases in the year ending March from a year ago.

Month over month, the National Index posted an 0.8% increase, while the 10-City and 20-City Composites posted increases of 1.0% and 1.1%, respectively. After seasonal adjustment, the National Index and the 20-City Composite posted a month-over-month increase of 0.5%, while the 10-City Composite a posted an 0.4% increase. In March, all 19 cities (excluding Detroit) reported increases before seasonal adjustment as well as after seasonal adjustment.

“March’s data witnessed the first impact of the COVID-19 pandemic,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “In all three cases, March’s year-over-year gains were ahead of February’s, continuing a trend of gently accelerating home prices that began last autumn. March results were broad-based. Prices rose in each of the 19 cities for which we have reported data, and price increases accelerated in 17 cities.

Lazzara noted this report covered real estate transactions closed during March. “Housing prices have not yet registered any adverse effects from the governmental suppression of economic activity in response to the COVID-19 pandemic,” he said. “As much of the U.S. economy remained shuttered in April, next month’s data may show a more noticeable impact.”

The report said as of March, average home prices for the MSAs within the 10-City and 20-City Composites are back to their winter 2007 levels.

Selma Hepp, deputy chief economist for CoreLogic, Irvine, Calif., noted strength in the home price growth “is a testament to pent up demand among Millennials who are viewing historically low mortgage rates and lull in the market activity as a unique opportunity to purchase their first home. And while the pandemic has introduced a lot of uncertainty about the economic outlook, the strong demand leading up the pandemic suggests there are many buyers who are still looking to buy a home but are waiting out for the economy to open up. Certainly, recent data suggests home buying activity picking up, which amid low for-sale inventory levels will continue to prop up home prices.”