Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.

Tag: Coronavirus

(The New Normal) Garth Graham: Shifting Teams at the Speed of a Pandemic

Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.

(The New Normal) Garth Graham: Shifting Teams at the Speed of a Pandemic

Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

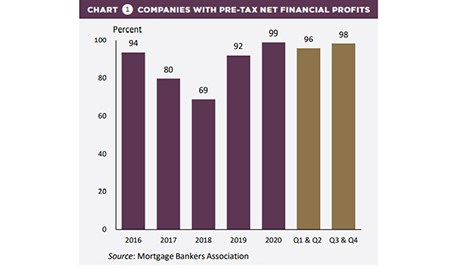

MBA: 2020 IMB Production Volumes, Profits Hit Record-Highs

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported Wednesday

Sponsored Content from SWBC: COVID-19 Disruptions Drive Tech-Focused Lender-Placed Insurance Programs

In this article, we’ll discuss how electronic data interchange (EDI) and robotic processing automation (RPA) technology are helping mortgage servicers improve the efficiency of their LPI process.

Millennials, Gen Z More Than Twice as Likely to Delay Financial Milestone Due to COVID-19

Although an increasing number of U.S. adults have been vaccinated and look forward to resuming pre-pandemic activities, a new Bankrate.com survey indicates that nearly two in five (39%) individuals have delayed a financial milestone because of the pandemic.

Brian Lynch: A Deeper Dive into Mortgage Accounting: Financial Reporting is More Important Than Ever Before

Loan officers, branch managers, c-level executives and more need access to granular financial data and in-depth accounting tools in a changing market. The pandemic rapidly spurred the adoption of tech solutions and heightened the industry’s reliance on technology – from helping lenders operate, to supporting loan officers in their day-to-day tasks, to increasing daily efficiencies for the accounting department.