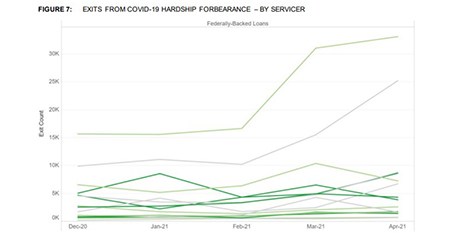

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.

Tag: Coronavirus

Rida Sharaf: Ready…Set… Go! The Mortgage Industry’s Upcoming Obstacle Course

As yet another extension of the nationwide pandemic eviction and foreclosure restrictions is put in place (at least for federally back mortgages), the mortgage industry is bracing for formidable challenges on a number of fronts.

MBA: 2021 Commercial/Multifamily Lending to Increase 31% to $578 Billion

Commercial and multifamily mortgage bankers are expected to close $578 billion in loans backed by income-producing properties in 2021, a 31 percent increase from 2020’s volume of $442 billion, according to a new forecast released Tuesday by the Mortgage Bankers Association.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.

Illinois, Florida, New Jersey Housing Markets Most At-Risk From Pandemic-Related Damage

Housing markets along the East Coast and in Illinois were most vulnerable to damage from the Coronavirus pandemic in the second quarter, reported ATTOM, Irvine, Calif.

Paradatec’s Neil Fraser: For Servicers, Pandemic-Related Challenges Are Just Beginning

Neil Fraser is Director of U.S. Operations for Paradatec, Cincinnati, Ohio, a provider of AI-based document classification and data extraction technology for mortgage loan processing. He manages all of Paradatec’s operations and has grown the company every year since its incorporation in 2002.

MBA, Real Estate Industry Commend Administration for Recovery Efforts; Call for End to Nationwide Eviction Moratorium

The Mortgage Bankers Association and a broad real estate coalition on Friday commended measures President Biden has taken to stabilize the housing sector and urged the administration to sunset the federal moratorium on evictions on June 30.

One-Third of Millennial Homebuyers Using Extra Savings from Pandemic for Down Payment

For nearly one-third (31%) of millennial first-time homebuyers, the ability to save extra money during the coronavirus pandemic helped them accumulate the money needed for a down payment, said Redfin, Seattle.

MBA Asks 6-Month Delay of Debt Collections Proposed Rule Effective Date

The Mortgage Bankers Association, in a May 19 letter, asked the Consumer Financial Protection Bureau to delay the effective date of its final rule amending the Fair Debt Collection Practices Act.

(The New Normal) Pooja Bansal: Eagerly Awaiting the End to Remote Work—At Least For Us

For example, a recent McKinsey survey of 800 corporate executives found that after the pandemic, nearly 40% expect their employees in remote services to continue working two or more days a week away from the office. Surely, there are many companies in our industry who are planning to do the same. We’re not one of them and because of that, the pandemic was a big challenge for us.