Mortgage applications rose for the third consecutive week as interest rates hovered at record levels, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 17.

Tag: Coronavirus

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

Brian Simons: The Modern Operating Model for Mortgage Lenders

In the last five years, lenders have made great strides with significant investments in best-in-class borrower experiences, navigating a plethora of new digital tools, all while adeptly navigating the ups and downs of the market. In my experience, unfortunately, most initiatives to cut costs and improve quality are short-lived or merely incremental. What I have found over my 25 years in this industry is that transformational growth only occurs when senior leadership commits itself to reevaluating their entire operating model.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

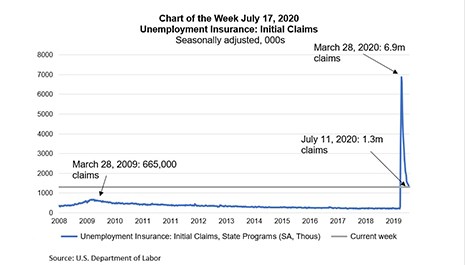

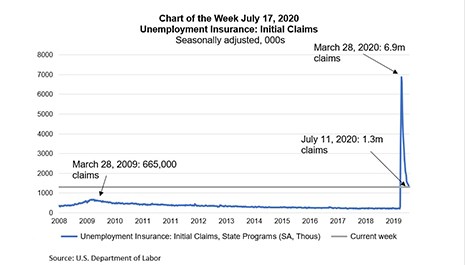

MBA Chart of the Week: Unemployment Insurance/Initial Claims

This week’s chart highlights initial unemployment claims data from the U.S. Department of Labor, portraying the speed and severity of the labor market’s deterioration during the COVID-19 pandemic, as businesses closed or transitioned to remote working arrangements.

MBA Chart of the Week: Unemployment Insurance/Initial Claims

This week’s chart highlights initial unemployment claims data from the U.S. Department of Labor, portraying the speed and severity of the labor market’s deterioration during the COVID-19 pandemic, as businesses closed or transitioned to remote working arrangements.