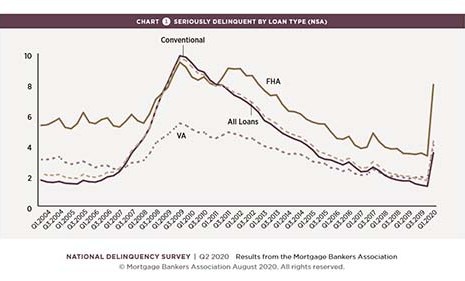

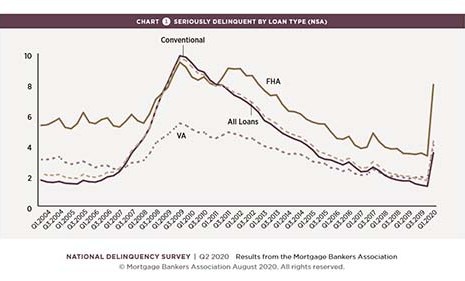

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

Tag: Coronavirus

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Record Traffic Spurs Home Builder Index to New High

It’s been quite a year for the National Association of Home Builders/Wells Fargo Housing Market Index. In April, amid the worst of the coronavirus pandemic, the Index plunged 30 points to its lowest level since 2012. Yesterday—just four months later—the Index reached its highest point in its 35-year history.

MBA: Loans in Forbearance Fall 9th Straight Week

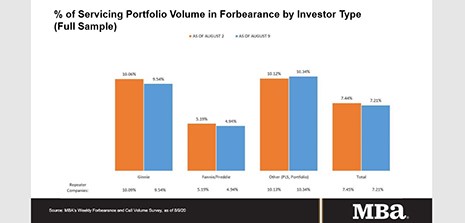

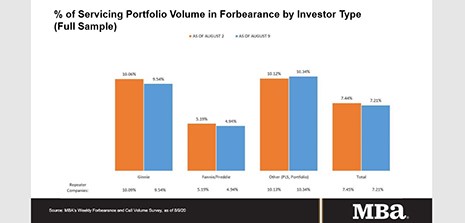

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

Sponsored Content from Nomis Solutions: What Are Mortgage Shoppers Looking for in 2020 and Beyond?

For our 2020 Consumer Lending Survey eBook, we dive deep into the minds of consumers in the market for a loan in this socially distanced COVID-19 environment.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association on Thursday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.