MBA: Loans in Forbearance Fall 9th Straight Week

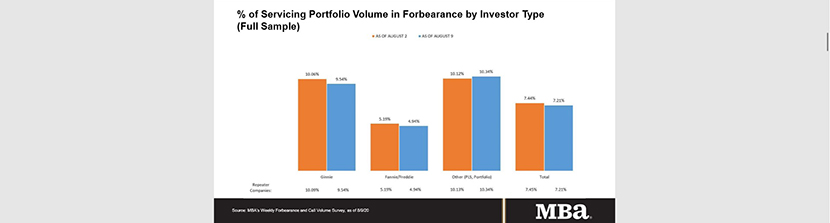

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

The survey reported the share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 10th week in a row to 4.94% – a 25-basis-point improvement. Ginnie Mae loans in forbearance decreased by 52 basis points to 9.54%, while the forbearance share for portfolio loans and private-label securities increased by 22 basis points to 10.34%. The percentage of loans in forbearance for depository servicers dropped to 7.49%; the percentage of loans in forbearance for independent mortgage bank servicers decreased to 7.42%.

“More homeowners exited forbearance last week, leading to the ninth straight drop in the share of loans in forbearance. However, the decline in Ginnie Mae loans in forbearance was again because of buyouts of delinquent loans from Ginnie Mae pools, which result in these FHA and VA loans being reported in the portfolio category,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “In a sign that more FHA and VA borrowers are struggling with a very tough job market, more Ginnie Mae borrowers requested than exited forbearance.”

Fratantoni noted the share of Fannie Mae and Freddie Mac loans in forbearance has dropped below 5% for the first time since April. “Borrowers with conventional mortgages have been faring somewhat better throughout the current crisis, and there is no sign to date from these data that the risk to the GSEs is increasing,” he said.

Key findings of the MBA Forbearance and Call Volume Survey – August 3 – 9

- Total loans in forbearance decreased by 23 basis points relative to the prior week: from 7.44% to 7.21%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased: from 10.06% to 9.54%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 5.19% to 4.94%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 10.12% to 10.34%.

- By stage, 38.80% of total loans in forbearance are in the initial forbearance plan stage, while 60.49% are in a forbearance extension. The remaining 0.70% are forbearance re-entries.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week from 0.12% to 0.11%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased from 7.8% to 7.9%.

- Average speed to answer decreased from 2.8 minutes to 2.2 minutes.

- Abandonment rates increased from 5.6% to 5.8%.

- Average call length decreased from 7.6 minutes to 7.5 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of August 9:

- Total: 7.21% (previous week: 7.44%)

- IMBs: 7.42% (previous week: 7.71%)

- Depositories: 7.49% (previous week: 7.63%)

The MBA Forbearance and Call Volume Survey represents 75% of the first-mortgage servicing market (37.3 million loans).