As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

Tag: Coronavirus

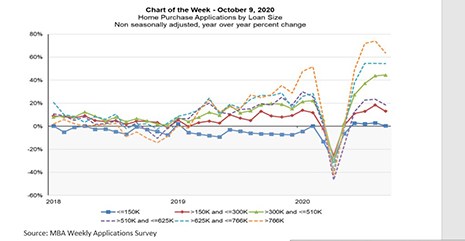

MBA Chart of the Week: Home Purchase Activity by Loan Size

This week’s MBA Chart of the Week highlights the year-over-year growth in purchase applications broken down by loan size tiers from 2018 to 2020.

Sponsored Content from Nomis Solutions: What Are Mortgage Shoppers Looking for in 2020 and Beyond?

We focused on the importance of pricing along the customer journey: during the hunt for a loan, when comparing lenders before completing an application, and (given the ease of comparing prices online these days) whether consumers continue to shop once their application is underway. From this, we identified five insights that will guide lenders as they evolve and enhance their pricing capabilities.

Julie Chipman: 5 Ways to Cultivate Culture while Onboarding Employees Remotely

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.

Sponsored Content from Origence: Steps for Post-COVID Mortgage Lending Success

While other industries have learned to deliver high levels of customer engagement and satisfaction online, many lenders are still originating loans much as they were 20 years ago.

MBA Chart of the Week: Home Purchase Activity by Loan Size

This week’s MBA Chart of the Week highlights the year-over-year growth in purchase applications broken down by loan size tiers from 2018 to 2020.

Sponsored Content from Nomis Solutions: What Are Mortgage Shoppers Looking for in 2020 and Beyond?

We focused on the importance of pricing along the customer journey: during the hunt for a loan, when comparing lenders before completing an application, and (given the ease of comparing prices online these days) whether consumers continue to shop once their application is underway. From this, we identified five insights that will guide lenders as they evolve and enhance their pricing capabilities.

Placing Capital in Uncertain Times: A Conversation with CBRE’s Val Achtemeier

MBA NewsLink interviewed Valerie Achtemeier, Executive Vice President at CBRE Capital Markets in the Debt & Structured Finance Group. Based in Los Angeles, Achtemeier leads a team in placing debt and equity on commercial real estate throughout the U.S.

Julie Chipman: 5 Ways to Cultivate Culture while Onboarding Employees Remotely

When our entire workforce at Embrace Home Loans went remote in April, we faced the challenge of how to help make new employees feel welcome and part of the team. We’ve learned that managers are one of the most effective resources for building company culture. And this holds true not only for mortgage companies, but for most other industries as well.

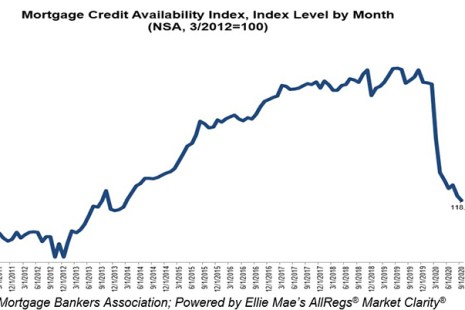

Mortgage Credit Availability Falls Again, Remains at 6-Year Low

Mortgage credit availability decreased in September, remaining at a six-year low, the Mortgage Bankers Association reported this morning.