MBA Chart of the Week: Home Purchase Activity by Loan Size

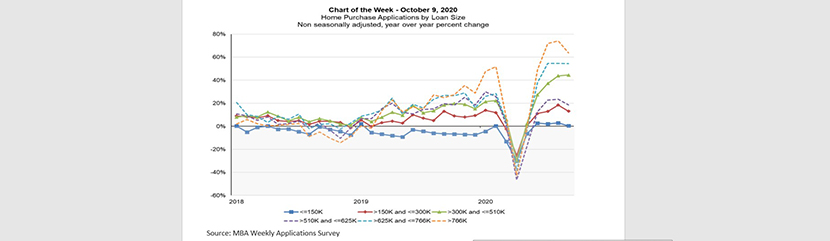

This week’s MBA Chart of the Week highlights the year-over-year growth in purchase applications broken down by loan size tiers from 2018 to 2020.

The onset of the COVID-19 pandemic caused a sharp drop in purchase activity in April and May, but there has been a sharp rebound in borrower demand. However, the purchase recovery has been driven by larger loan size categories. More households transitioning to remote work and at-home education arrangements is likely adding to this growth.

Between June to September, purchase applications with loan amounts higher than $766,000 showed growth that ranged between 49 percent to 74 percent, while loans between $625,000 and $766,000 grew between 38 percent to 55 percent. In contrast, applications for loans between $150,000 and $300,000 climbed from 11 percent to 13 percent, while the smallest loan size tier of $150,000 or less increased no more than 3 percent in each of those months.

There are several drivers for the uneven housing recovery observed since the summer. The current economic crisis is impacting certain sectors of the economy disproportionately. For example, workers in leisure and hospitality, and education, saw substantial layoffs in the spring that have been slow to recover. They typically make up borrowers seeking mortgages in the lower price tier. Second, the economic and labor market deterioration led to a reduction in mortgage credit supply, including government loans that a high share of entry-level home buyers utilize, further restraining growth.

Lastly, housing inventory was tight leading up to the pandemic, especially at the entry-level, and even as new construction has rebounded, there is still a shortage. The result is a more competitive market and greater affordability challenges as prices are bid higher, preventing some of these transactions from happening.

MBA expects the purchase market to continue to grow heading into 2021, but the pace of that recovery, and whether growth will be spread more evenly across price tiers, will depend on how the hardest hit sectors recover – both in terms of workers finding more stable employment and making up for lost income.