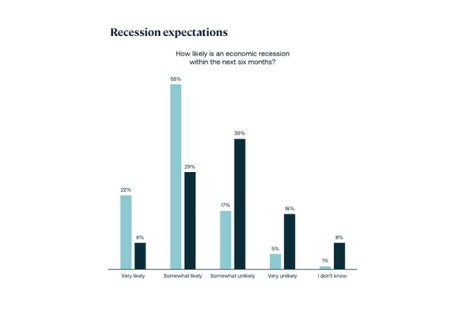

Altus Group, Toronto, released its Q3 Commercial Real Estate Industry Conditions and Sentiment Survey, finding that the number of respondents who cited “deploying capital” as a primary focus over the next 6 months grew to 31%.

Tag: Commercial Real Estate

SitusAMC: Commercial Real Estate Values Stabilize; Investor Sentiment Improves

The commercial real estate market appears to be stabilizing, with market participants seeing relief on the horizon as interest rates have started to decline, according to SitusAMC’s latest CRE Debt and Valuation Trends analysis.

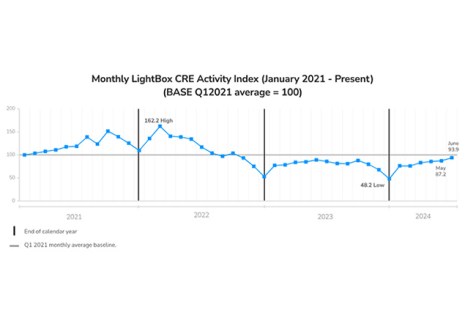

LightBox Finds Slow Improvement in CRE Activity

The commercial real estate sector is adjusting to the fact that the Federal Reserve may lower interest rates only once this year–or possibly, not at all–according to LightBox, New York.

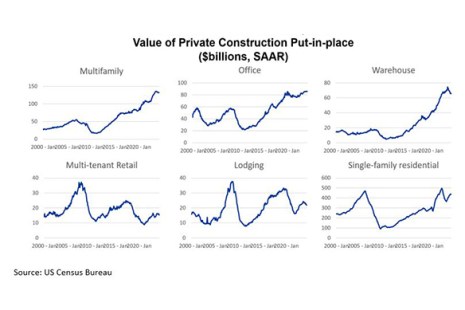

MBA Chart of the Week: Value of Private Construction Put-in-Place

Physicists have protons, neutrons, and electrons. Biologists have DNA and RNA. And economists have supply and demand — the building blocks upon which most of our understanding of markets rest.

Altus Group Survey: Increase in Prioritizing ‘Deploying Capital’ in Near Term

Altus Group, Toronto, released its Commercial Real Estate Industry Conditions and Sentiment Survey for Q1, finding U.S. respondents who expect their primary focus to be deploying capital in the next 6 months grew from 7% at the end of 2023 to 25% in the most recent quarter.

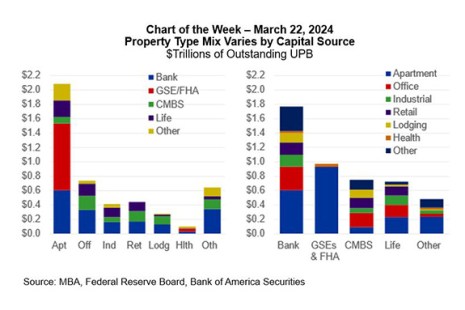

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

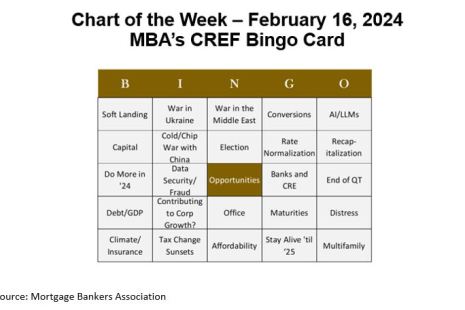

Chart of the Week: MBA’s CREF Bingo Card

Many of us just returned from MBA’s Commercial Real Estate/Multifamily Finance Convention and Expo. That means we showcased our annual CREF BINGO card, highlighting the topics expected to be discussed in sessions, meetings, hallways and over drinks.

DLA Piper: ‘Community’ Theme Among 2023 Commercial Real Estate Trends

DLA Piper, London, released its 2023 Year-End Real Estate Trends report, noting that its transaction volume has begun to resemble pre-pandemic levels. In terms of what that environment looks like, the firm reported community–where people live and the goods and services they want close to home–was a recurring presence.

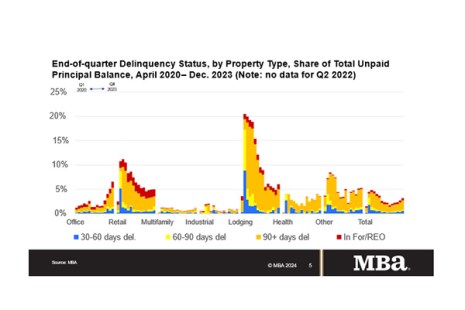

MBA Chart of the Week: End of Quarter Delinquency Status

Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

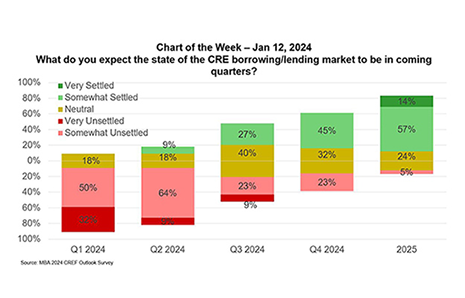

MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

Even though many commercial real estate loans are long-lived, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.