Given the impacts of artificial intelligence likely to be felt across real estate finance, MBA Newslink interviewed Greystone’s Chief Information Officer Niraj Patel to get his insights on where we are and what we can expect going forward.

Tag: Commercial Real Estate

KBRA CMBS Outlook: Cloudy, With a Glimmer of Hope

Kroll Bond Rating Agency, New York, just released its CMBS 2024 Sector Outlook, which forecasts U.S. issuance activity for the new year and highlights key credit trends from 2023. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their views on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2024.

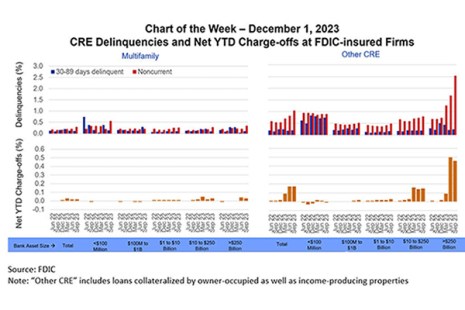

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

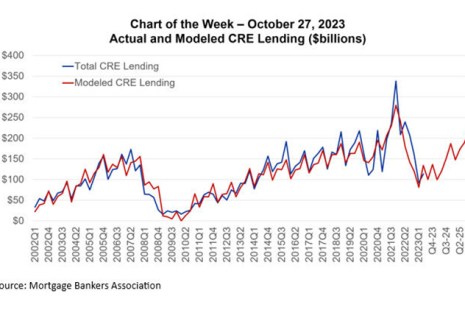

MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).

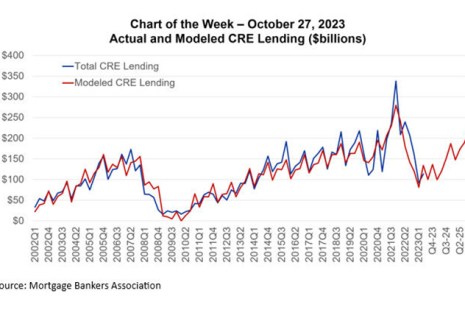

MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).

MBA Forecast: Commercial/Multifamily Lending Expected to Fall 46% to $442 Billion in 2023

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $442 billion this year, a 46% decline from 2022’s total of $816 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association.

JLL’s Mike Ellis and Tony Lenamon Discuss CRE Valuation and Risk Advisory

MBA NewsLink interviewed JLL Value and Risk Advisory group CEO Mike Ellis and Head of Client Engagement Tony Lenamon about commercial real estate valuation and other challenges.

JLL’s Mike Ellis and Tony Lenamon Discuss CRE Valuation and Risk Advisory

MBA NewsLink interviewed JLL Value and Risk Advisory group CEO Mike Ellis and Head of Client Engagement Tony Lenamon about commercial real estate valuation and other challenges.

Green Street: CRE Sales Volume Down Nearly 50% Compared to Last Year

Commercial real estate sales volume is down approximately 50% compared to last year’s second quarter, according to Green Street, Newport Beach, Calif.

JLL’s Mike Ellis and Tony Lenamon Discuss CRE Valuation and Risk Advisory

MBA NewsLink interviewed JLL Value and Risk Advisory group CEO Mike Ellis and Head of Client Engagement Tony Lenamon about commercial real estate valuation and other challenges.