DLA Piper: ‘Community’ Theme Among 2023 Commercial Real Estate Trends

(Image courtesy of DLA Piper)

DLA Piper, London, released its 2023 Year-End Real Estate Trends report, noting that its transaction volume has begun to resemble pre-pandemic levels. In terms of what that environment looks like, the firm reported community–where people live and the goods and services they want close to home–was a recurring presence.

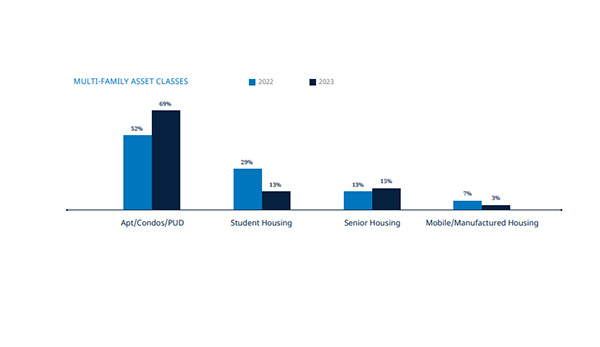

In terms of acquisition and disposition trends, multifamily was the most active asset class within purchase and sale work. Apartments, condos and planned unit developments were strong, senior housing grew slightly and student housing and manufactured home deals dipped slightly in 2023 from 2022.

Buyers are investing in neighborhood and grocery-anchored retail, along with mixed-use development. Additionally, industrial and data center properties saw a steady 2023.

Offices continued to face challenges, however.

DLA Piper reported little change from mid-year to year-end in survival periods for sellers’ reps and warranties, with 270 days holding as the most common survival period. Also, there were no significant changes between the mid-year and year-end statistics in the average liability caps and baskets for a breach of sellers’ reps and warranties.

The firm also observed a slight increase (2 percentage points) in the frequency of financing contingencies, most of which were in the form of loan assumption conditions.

In terms of property management trends, DLA Piper didn’t see significant changes from mid-year to year-end in the property management fee as a percentage of the property’s revenue. But, the frequency of a property management liability cap decreased from 9.18% to 6.23%.

Construction management fees as a percentage of the cost of the work didn’t move significantly over that time period, but almost 4 percentage points more of the construction management fees the firm negotiated limited the fee to hard costs only.