MBA Newslink recently interviewed Malay Bansal, Head of Trading & Capital Markets at 3650 Capital, who shared insights about the CMBS issuer ecosystem and CRE securitization markets.

Tag: Commercial Mortgage-Backed Securities

CMBS Market Musings: An Interview with Malay Bansal from 3650 Capital

MBA Newslink recently interviewed Malay Bansal, Head of Trading & Capital Markets at 3650 Capital, who shared insights about the CMBS issuer ecosystem and CRE securitization markets.

CMBS Market Musings: An Interview with 3650 Capital’s Malay Bansal

MBA Newslink recently interviewed Malay Bansal, Head of Trading & Capital Markets at 3650 Capital, who shared insights about the CMBS issuer ecosystem and CRE securitization markets.

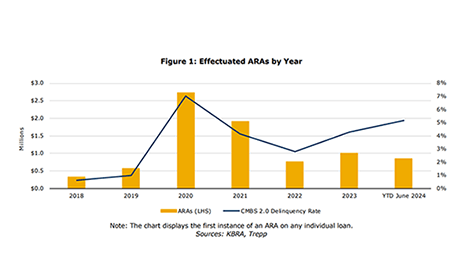

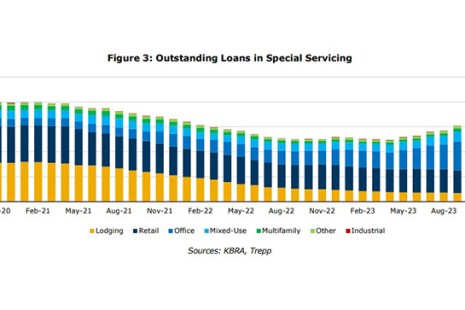

KBRA Says CMBS Appraisal Reductions are Climbing

Kroll Bond Rating Agency, New York, reported that commercial mortgage-backed securities appraisal reduction amounts–ARAs–have climbed in tandem with delinquency rates.

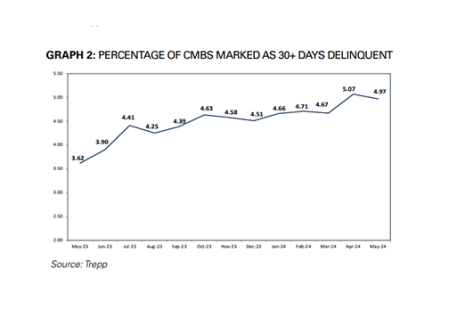

Trepp Reports CMBS Delinquency Rate Dips

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

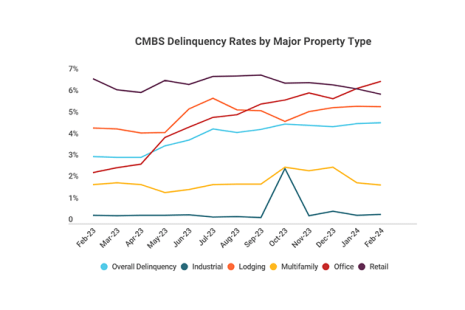

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

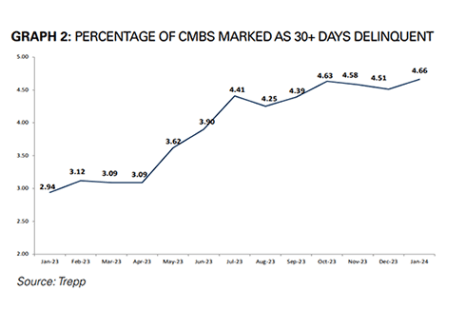

CMBS Delinquency Rate Ticks Upward: Trepp

The CMBS delinquency rate rose modestly in January, increasing 15 basis points to 4.66%, according to Trepp, New York.

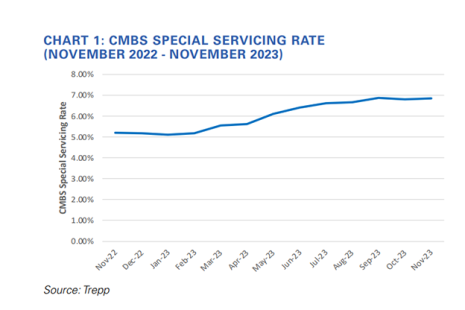

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

KBRA CMBS Outlook: Cloudy, With a Glimmer of Hope

Kroll Bond Rating Agency, New York, just released its CMBS 2024 Sector Outlook, which forecasts U.S. issuance activity for the new year and highlights key credit trends from 2023. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their views on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2024.

KBRA: CMBS Delinquency Rate Ticks Upward

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.