Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

(Illustration courtesy of Trepp)

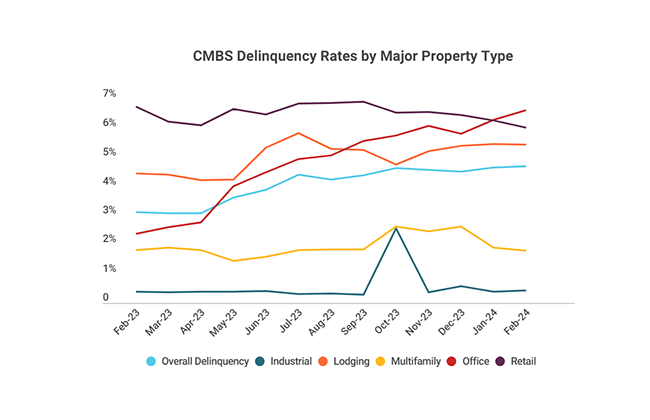

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

The overall delinquency rate rose five basis points to 4.71%, mostly due to a 33-basis-point increase in the heavily watched office sector. Office CMBS delinquencies rose to 6.63%.

Year over year, the overall U.S. CMBS delinquency rate is up 159 basis points.

“The month-over-month increase in February is roughly in line with the average monthly increase for the sector over the prior 12 months, increasing by 37 basis points per month on average,” Trepp Research Director Stephen Buschbom said in Trepp’s monthly report.

Trepp said the retail segment notched the largest decline of all property sectors for the month with a 24 basis point dip to 6.03%.

If loans that are beyond their maturity date but current on interest are included, the delinquency rate would be 5.69%, up seven basis points from January, the report said. The percentage of loans in the 30 days delinquent bucket is 0.30%, up six basis points from January.

Trepp’s numbers assume defeased loans remain part of the denominator unless otherwise specified.