Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.

Tag: CMBS

Trepp Reports CMBS Delinquency Rate Rises Again in December

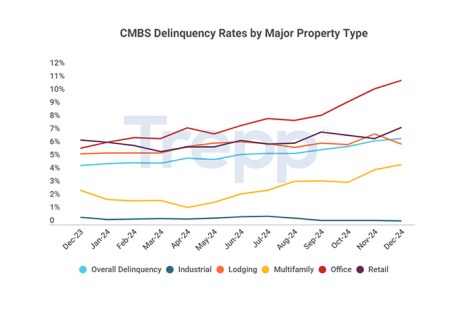

Trepp, New York, reported its CMBS delinquency rate rose in December, with the overall rate up 17 basis points to 6.57%.

Fitch: Large Office Defaults Drive CMBS Delinquency Rate Higher in November

Fitch Ratings, Chicago, reported that the U.S. commercial mortgage-backed securities delinquency rate increased six basis points in November to 3.25%.

Top CMBS Issues to Watch in 2025: An MBA NewsLink Roundtable

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.

The Top CMBS Issues to Watch in 2025: An MBA NewsLink Roundtable

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.

Trepp: CMBS Delinquency Up in November

Trepp, New York, reported the CMBS delinquency rate grew 42 basis points to 6.4%.

NewsLink Q&A: KBRA’s 2025 CMBS Outlook: Twin Peaks?

Kroll Bond Rating Agency just released its CMBS 2025 Sector Outlook, which forecasts issuance activity for the new year. MBA NewsLink interviewed two KBRA analysts about the current lending environment as well as factors that may affect property performance in 2025.

A NewsLink Q&A With KBRA About its 2025 CMBS Outlook: Twin Peaks?

Kroll Bond Rating Agency just released its CMBS 2025 Sector Outlook, which forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed two KBRA analysts for their views on the current lending environment as well as factors that may affect overall property performance in 2025.

A Q&A With KBRA About its 2025 CMBS Outlook: Twin Peaks?

Kroll Bond Rating Agency just released its CMBS 2025 Sector Outlook, which forecasts U.S. issuance activity for the new year. MBA NewsLink interviewed two KBRA analysts for their views on the current lending environment as well as factors that may affect overall property performance in 2025.

CMBS Market Musings: Malay Bansal from 3650 Capital

MBA Newslink recently interviewed Malay Bansal, Head of Trading & Capital Markets at 3650 Capital, who shared insights about the CMBS issuer ecosystem and CRE securitization markets.