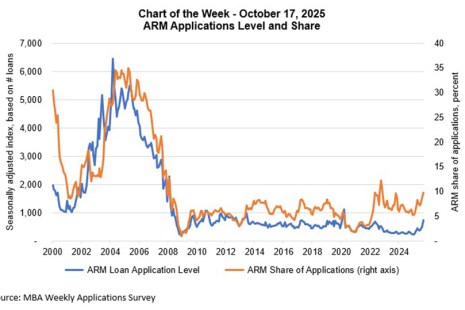

Adjustable-rate mortgages (ARMs), when used appropriately, can help ease affordability challenges and provide homeownership and equity building opportunities for qualified borrowers.

Tag: Chart of the Week

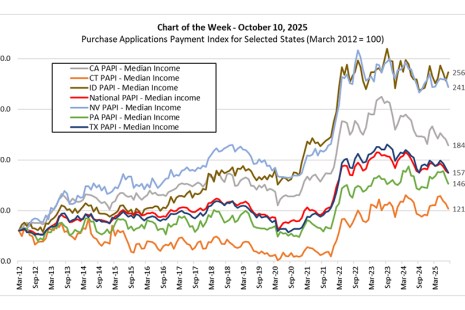

Chart of the Week: Purchase Applications Payment Index for Selected States

In this week’s Chart of the Week, we show the PAPI series – constructed using median Weekly Applications Survey (WAS) payments and median income – for the nation and six selected states.

Chart of the Week: Multifamily Market Share by Capital Source

This Chart of the Week focuses on the distribution of the multifamily market share by capital source. The multifamily market is a fundamental part of the broader commercial real estate market, and originations have been strong throughout 2025. The figure reports MBA estimates of the shares of originations by each capital source, overlaid with total multifamily origination volumes.

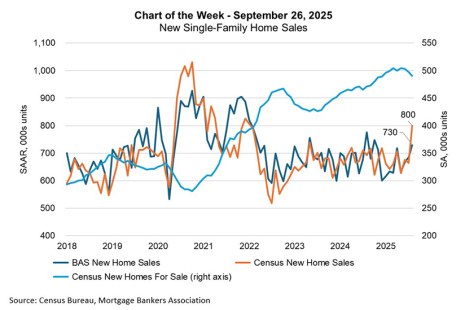

Chart of the Week: New Single-Family Home Sales

MBA’s estimate of new home sales, based on a larger sample than the one used by the Census Bureau, suggests that the increase in new home sales was smaller in August than Census calculated.

Chart of the Week: FOMC Summary of Economic Projections for Fed Funds Rate

Each quarter, the Federal Open Market Committee submit their projections for various economic measures. This month’s projections, shown in the Summary of Economic Projections, include 2028 for the first time.

Chart of the Week: IMB Net Production Income and Percent of IMBs With Pre-Tax Net Income > Zero

Independent mortgage banks and mortgage subsidiaries of chartered banks reported pre-tax net production profit of 25 bps ($950 per loan) on each loan they originated in the second quarter.

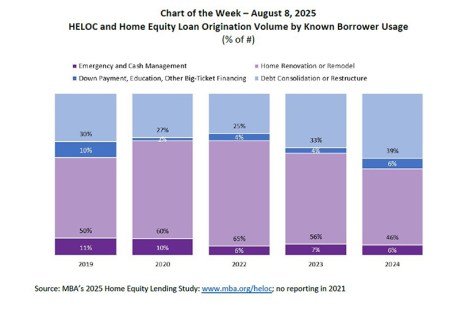

Chart of the Week: HELOC and Home Equity Loan Origination Volume by Known Borrower Usage

MBA recently completed its 2025 Home Equity Lending Study, tracking trends in origination and servicing for home equity lines of credit (HELOCs) and home equity loans.

Chart of the Week: 2024 HMDA Respondents

A total of 4,758 companies reported lending activity under the Home Mortgage Disclosure Act in 2024, according to MBA’s analyses of the dataset.

Chart of the Week: Cost of Servicing Performing and Non-Performing Loans

According to MBA’s latest Servicing Operations Study and Forum, fully-loaded mortgage servicing costs of performing loans averaged $176 per loan in 2024, while the costs of non-performing loans averaged $1,573 per loan.

Chart of the Week: Average Turn Times for Broker Wholesale & Non-Delegated Correspondent Production Channels

This week’s Chart of the Week details turn times for the broker wholesale and non-delegated correspondent production channels in the first quarter of 2025.