Chart of the Week: New Single-Family Home Sales

Source: Census Bureau, Mortgage Bankers Association

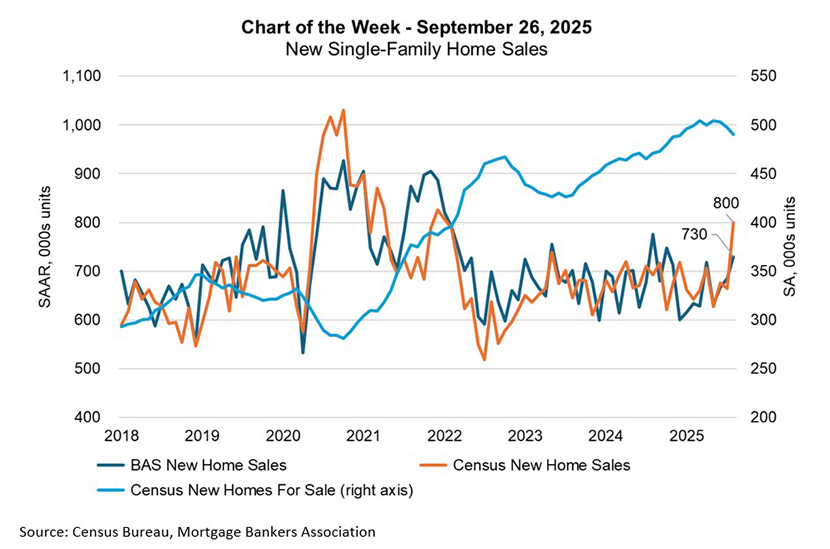

New home sales increased in August. However, many analysts have questioned whether the Census Bureau’s New Residential Sales report for August overstates this increase. MBA’s own estimate of new home sales, based on a larger sample than that used by Census, suggests that the increase was smaller, and indicates that Census will likely revise their number down in future months.

MBA’s Builder Applications Survey (BAS) estimated that new home sales increased for the third consecutive month in August to a seasonally adjusted annual rate of 730,000 units, the strongest sales pace in almost a year. The seasonally adjusted estimate for August is an increase of 6.6 percent from the July pace of 685,000 units. The MBA’s new home sales estimate is derived from mortgage application data from the BAS sample, which includes the mortgage affiliates of builders across the country and is estimated to cover approximately half of all new home sales. The BAS new home sales estimate is released prior to the Census estimate and has consistently served as a leading indicator of the Census Bureau’s New Residential Sales report, as shown above.

The August figures from the Census showed new home sales at an annual rate of 800,000 units, 20.5 percent higher than the July pace of 664,000 units. This was the highest pace since January 2022. Additionally, there were upward revisions to the prior two months’ results.

For-sale inventory levels for newly constructed homes continue to grow, reaching levels not seen in 18 years. A large share of recent home sales have been for completed units or those under construction. Elevated inventories are exerting downward pressure on home prices and causing home builders to offer concessions to buyers. New homes are priced to sell quickly, which should support sales volume in the months ahead. As market participants and analysts try to make sense of the various cross-currents today – a weakening economy and job market, declining mortgage rates, higher for-sale inventory – having multiple data sources will provide a better read on the health of the housing market. We recommend keeping an eye on the BAS.