Boston National Title Agency announced a strategic alliance with Clarifire, Charlotte, N.C. Users of CLARIFIRE for default servicing and loss mitigation will now benefit from its integration with platforms from Boston National Title.

Tag: Black Knight

Industry Briefs June 24, 2022: Boston National Title, Clarifire Partner on Streamlined Default Servicing

Boston National Title Agency announced a strategic alliance with Clarifire, Charlotte, N.C. Users of CLARIFIRE for default servicing and loss mitigation will now benefit from its integration with platforms from Boston National Title.

Industry Briefs June 14, 2022: OptifiNow Implements CRM Platform for Reverse Mortgage Lender

OptifiNow, Seal Beach, Calif., deployed its custom CRM platform for Reverse Mortgage Lending, a reverse mortgage originator based in San Diego. Reverse Mortgage Lending selected OptifiNow as its CRM platform to manage its marketing campaigns and track loans in process more effectively.

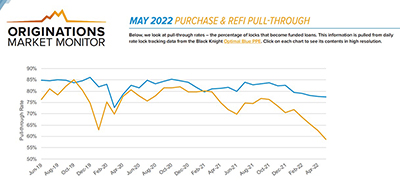

Rate Locks Fall Across All Loan Types

Black Knight, Jacksonville, Fla., said despite a leveling off in interest rates, lock volumes fell another 4.8% from April, with monthly declines seen across both rate/term (-23.6%) and cash-out (-11.9%) refinances.

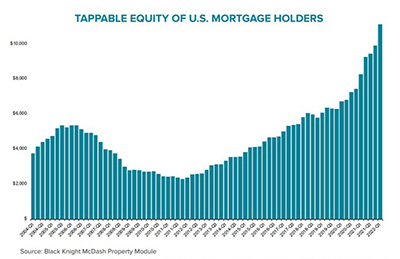

Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.

Housing Market Roundup: May 20, 2022

Catching you up on housing and economic reports that came across the MBA NewsLink desk this week during and after the MBA National Secondary and Capital Markets Conference & Expo in New York:

Industry Briefs May 19, 2022: Narrow Gauge Capital Acquires Inco-Check LLC

Inco-Check LLC, Boston, announced Narrow Gauge Capital completed acquisition of a majority interest in the company.

Black Knight: Rate Lock Activity Falls as Interest Rates Climb

Black Knight, Jacksonville, Fla., said amid rising interest rates, rate-lock production fell by nearly 20 percent in March, led by a sharp drop—more than 50 percent—in rate/term refinance activity.

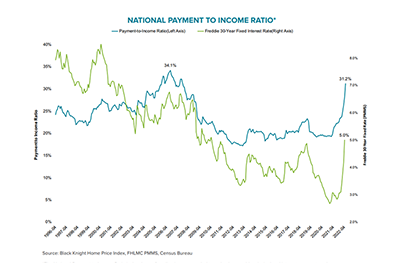

Borrower Behavior Changing as Home Affordability Drops

Though home price appreciation slowed slightly in March, 30-year mortgage interest rates above 5 percent have pushed affordability to nearly its worst-ever level, said Black Knight, Jacksonville, Fla.

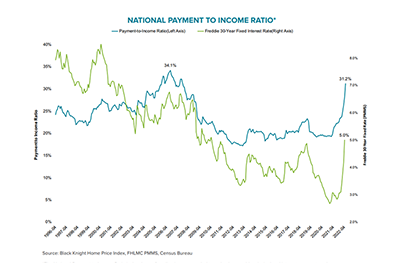

Borrower Behavior Changing as Home Affordability Drops

Though home price appreciation slowed slightly in March, 30-year mortgage interest rates above 5 percent have pushed affordability to nearly its worst-ever level, said Black Knight, Jacksonville, Fla.