Intercontinental Exchange, Atlanta, released the November 2023 Mortgage Monitor Report, highlighting that high interest rates continue to drag down affordability and dampen demand.

Tag: Black Knight

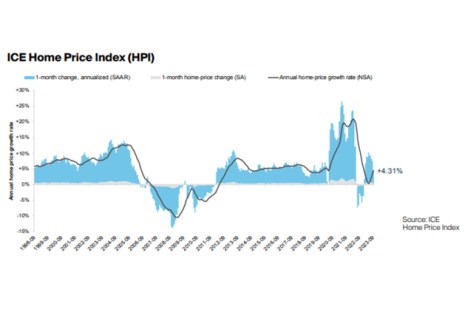

Black Knight: Home Prices Set Yet Another Record in August, Pushing Annual Growth Rate Sharply Higher

Home prices rose an “exceptionally strong” seasonally adjusted 0.68% in August, according to Black Knight’s ICE Mortgage Monitor Report.

Mortgage Cadence’s Joseph Camerieri Discusses the Mortgage Environment Post-Black Knight/ICE Merger

MBA NewsLink spoke with Joseph Camerieri of Mortgage Cadence about the mortgage landscape after the Black Knight/ICE merger, and what it will take to succeed in such an environment.

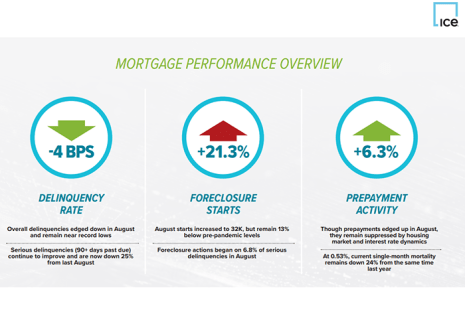

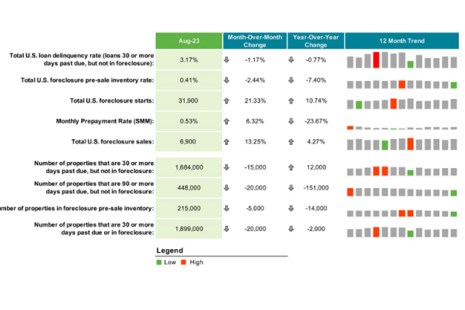

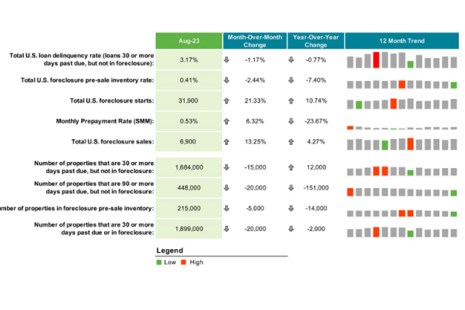

Black Knight: First Look August Delinquency Numbers Positive

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

Mortgage Cadence’s Joseph Camerieri Discusses the Mortgage Environment Post-Black Knight/ICE Merger

MBA NewsLink spoke with Joseph Camerieri of Mortgage Cadence about the mortgage landscape after the Black Knight/ICE merger, and what it will take to succeed in such an environment.

Black Knight: First Look August Delinquency Numbers Positive

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

Mortgage Cadence’s Joseph Camerieri Discusses the Mortgage Environment Post-Black Knight/ICE Merger

MBA NewsLink spoke with Joseph Camerieri of Mortgage Cadence about the mortgage landscape after the Black Knight/ICE merger, and what it will take to succeed in such an environment.

Mortgage Cadence’s Joseph Camerieri Discusses the Mortgage Environment Post-Black Knight/ICE Merger

MBA NewsLink spoke with Joseph Camerieri of Mortgage Cadence about the mortgage landscape after the Black Knight/ICE merger, and what it will take to succeed in such an environment.

Industry Briefs Sept. 25, 2023

Industry briefs from Black Knight, Grid151 and Land Gorilla.

Industry Briefs Sept. 22, 2023

Industry briefs from Black Knight, Grid151 and Land Gorilla.