Borrower Behavior Changing as Home Affordability Drops

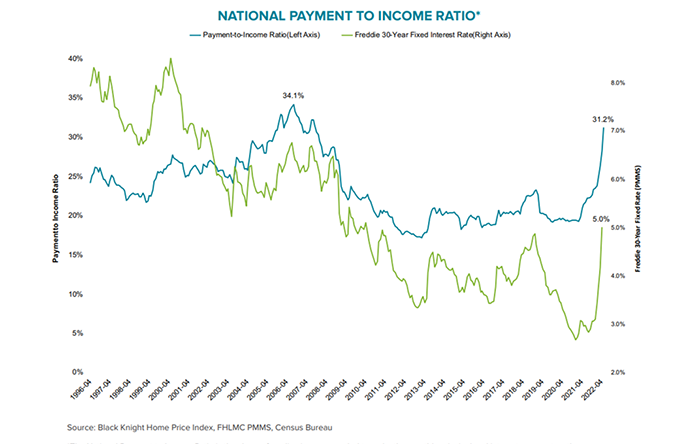

Though home price appreciation slowed slightly in March, 30-year mortgage interest rates above 5 percent have pushed affordability to nearly its worst-ever level, said Black Knight, Jacksonville, Fla.

“After accelerating for the last four months, the rate of annual home price growth actually slowed a bit in March,” Graboske said. Still, at 19.9 percent–down from an upwardly revised 20.1 percent in February–March would have otherwise set yet another record for appreciation, he noted.

Graboske said nearly 25 percent of the nation’s largest markets have seen 7-plus percent gains over the last three months alone. With 30-year interest rates hitting 5.11 percent as of April 21, the impact these price gains have had on home affordability is significant, he said.

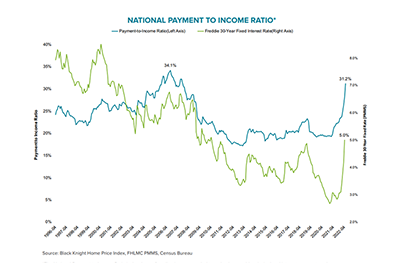

“As measured by the share of median income required to make the P&I payment on the average-priced home bought with 20 percent down, U.S. housing was the least affordable ever back in July 2006,” Graboske said. At the time, it took 34.1 percent of median income to make that P&I payment. At February’s endthat metric reached 29.1 percent, “and both rates and prices have continued to climb since then,” he said.

The Black Knight Mortgage Monitor report found these market dynamics have made ARMs increasingly more attractive to borrowers. “Indeed, the spread between 30-year and ARM offerings is now the widest it’s been since 2014 and within 20 basis points of an all-time high,” the report said. As of mid-April, the average 5/1 ARM had a 1.3 percent lower initial rate than 30-year mortgages. In turn, the ARM share of purchase rate locks by volume has spiked from 2.5 percent in December to nearly 8 percent in March, the highest such share since Optimal Blue began reporting the metric in 2017.

“Finally, though the appetite for ‘Expanded Guideline’ purchase loans–a proxy for the non-qualified mortgage market–was all but non-existent early in the pandemic, rate locks on such loans have since hit a multi-year high driven by widening spreads, tightened affordability and increased investor appetite,” Black Knight said. “While such loans only made up approximately 3 percent of all purchase locks in recent months, they are worth keeping an eye on given continued market shifts.”