Chart of the Week: Employee Benefits Costs for Mortgage Lenders, Servicers

(Source: MBA and STRATMOR Peer Group Roundtable Program, www.mba.org/pgr)

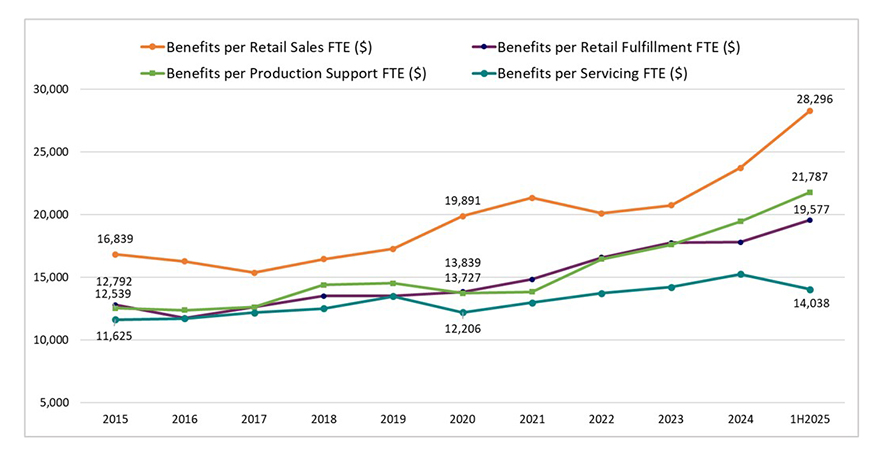

The beginning of the calendar year brings changes to employee benefits and associated costs for both mortgage company employers and employees. Based on data collected through the MBA and STRATMOR Peer Group Roundtables Program, this week’s Chart of the Week shows that residential lender-paid and servicer-paid costs have generally increased over the past five years, from 2020 to the first half of 2025, at a faster pace than the previous five years, from 2015 to 2020.

Benefits costs include the employer’s expenses for health and dental insurance, employer-paid taxes, pension or 401(k) contributions, severance, and other employee-related expenses, such as long-term disability insurance. For purposes of this analysis, we compare benefits costs per full-time equivalent (FTE) for retail sales personnel (such as retail loan officers, loan officer assistants ,and branch and regional managers) as well as retail fulfillment personnel (such as processors, underwriters, and closers). In addition, benefits costs per FTE for production support functions (such as production technology, secondary and capital markets, post-closing and quality control) and servicing functions are displayed.

Benefits costs per FTE for retail sales personnel averaged over $28,000 in the first half of 2025, a 68% increase over the ten-year period, with steeper escalations in more recent years. Fulfillment and production support also trended upward, particularly in the last five years that saw costs increase by 59% and 41% respectively. The least substantive change in benefits was for servicing functions, in which costs averaged $14,038 in the first half of 2025 from $11,625 per servicing FTE in 2015 – an increase of 21%. The movement of permanent servicing employees offshore may explain the relatively moderate increase in servicer-paid benefits costs.

At a time when production margins are compressed, mortgage lenders and servicers must consider ways to contain costs – including benefits costs – while continuing to attract top talent.

To gather more information on benefits, particularly employer vs employee-borne costs, MBA is excited to launch a residential member survey focused on Employee Benefits. The survey is primarily focused on healthcare benefits for residential lenders and servicers and is designed to be completed in 20 minutes or less. We are hopeful that the results will provide useful benchmarks for internal use at your organization. Please Complete the Employee Benefits Survey. The due date is Jan. 9. We will present survey highlights at a webinar on Jan. 27 at 1 PM ET. More details on the webinar will be available soon.

– Marina B. Walsh, CMB (mwalsh@mba.org); Jenny Masoud(jmasoud@mba.org)