GSEs Completed 52,154 Foreclosure Prevention Actions in 1Q, FHFA Finds

(Illustration courtesy of FHFA)

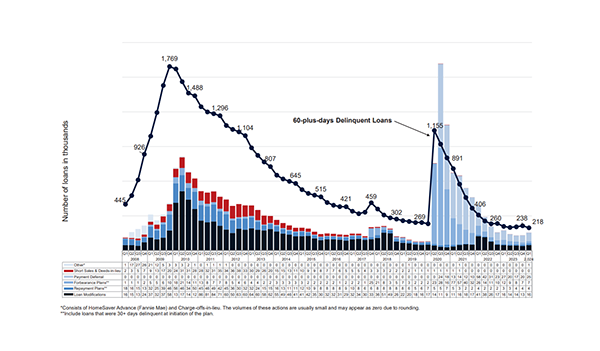

Fannie Mae and Freddie Mac completed more than 52,000 foreclosure prevention actions in the first quarter, bringing the total to nearly 7 million since the start of conservatorships, the Federal Housing Finance Agency reported.

Of these actions, 6.2 million have helped troubled homeowners stay in their homes, including 2.6 million permanent loan modifications, FHFA’s Foreclosure Prevention, Refinance, and Federal Property Managers Report said.

Initiated forbearance plans decreased to 21,050 in the first quarter from 24,579 in late 2023, FHFA reported. The total number of loans in forbearance at the end of the quarter equaled 34,348, representing approximately 0.11% of the total loans serviced and 7% of the total delinquent loans.

FHFA said 20% of modifications in the first quarter were modifications with principal forbearance. “Modifications that include extend-term only accounted for 79% of all loan modifications during the quarter,” the report said. “There were 142 completed short sales and deeds-in-lieu during the quarter, bringing the total to 705,057 since the conservatorships began in September 2008.”

The Enterprises’ Mortgage Performance

The 60-plus day delinquency rate decreased from 0.77% at the end of the fourth quarter of 2023 to 0.70 percent at the end of the first quarter of 2024, FHFA reported. The enterprises’ serious–90-day or more–delinquency rate declined to 0.51% at the end of the first quarter. “This compared with 3.18% for Federal Housing Administration loans, 2.01% for Veterans Affairs loans, and 1.44% for all loans (industry average),” the report said.

The Enterprises’ Foreclosures

Foreclosure starts fell slightly to 18,643 while third-party and foreclosure sales declined 3% to 3,178 in the first quarter, FHFA noted.

1Q24 Highlights — Refinance Activities

Total refinance volume decreased in the first quarter. Mortgage rates rose in March: the average interest rate on a 30-year fixed-rate mortgage increased to 6.82%.

“The percentage of cash-out refinances was 70% in March after rising as high as 82% over the last two years,” FHFA said. “Higher mortgage rates have reduced the opportunities for non-cashout borrowers to refinance at lower rates and lower their monthly payments.”