BREAKING NEWS

Applications Fall 5th Straight Week in MBA Weekly Survey

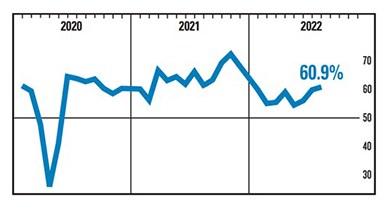

Mortgage applications fell for the fifth straight week, remaining at their lowest level in 22 years as interest rates rose again, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 2.

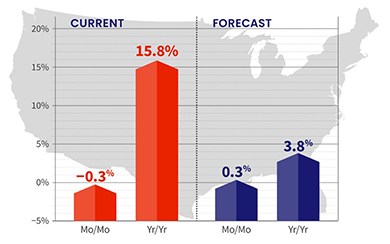

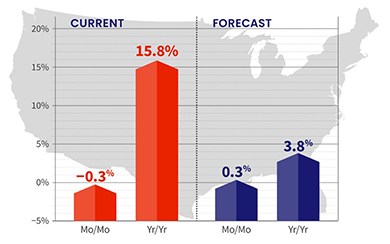

CoreLogic, Irvine, Calif., said annual home price appreciation fell for the third straight month in July as higher mortgage rates cooled off a red-hot housing market.

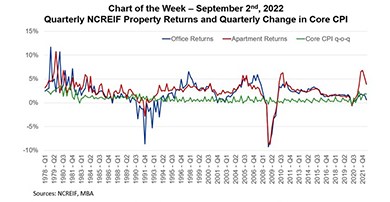

Trepp LLC, New York, reported real estate investment trust earnings turned positive in the second quarter as most firms beat their consensus earnings estimates.

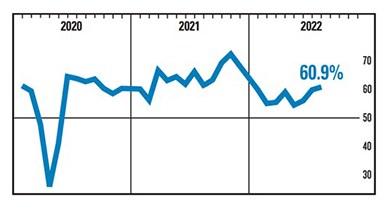

Economic activity in the services sector rose in August for the 27th month in a row, and at the fastest pace in four months, the Institute for Supply Management, Tempe, Ariz., reported Tuesday.

On Wednesday, FHFA announced that it would begin a comprehensive review of the Federal Home Loan Bank System this fall. And HousingWire published a guest column penned by MBA’s Mike Fratantoni, Marina Walsh, CMB, and Joel Kan that looks at industry employment levels in the current and forecasted mortgage market environment.

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

Join the MBA Legislative and Political Affairs Team for the Mortgage Action Alliance Quarterly Webinar on Thursday, Sept. 8 from 3:00-4:00 p.m. ET.

JLL Capital Markets, Chicago, arranged $62.8 million in construction financing for Phase I of Logistics 16 at Ottawa Farms, a three-building industrial facility in Savannah, Ga.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

NAMMBA and iEmergent have been working to create a tool (called Diversifi) that will allow anyone in the real estate finance business to better understand the market they serve, reach more of that market and create connections and relationships with them.

Will Robinson is the CEO of Encapture, Dallas, a high-growth SaaS platform that helps banks automatically extract important information from documents. Launched 20 years ago, Encapture helps companies save time and money by using machine learning to process large amounts of data.

While the Fed may influence mortgage rates, it is ultimately lenders and investors who decide what rate to offer based on market conditions and other factors.

Designing the future beyond the current downturn requires a comprehensive examination of what is necessary across digital financial actions—by the consumer, by the investor, by the regulators, and by rising non-traditional competitors. Traditional strategy encased by technology is the norm—but moving forward has this prescription lost its efficacy? Will we adapt—or will we die?